MyProtection Legacy

MyProtection Legacy is a traditional life insurance product with periodic premium payments that provides death benefits until the insured reaches 100 years old and maintains a financial plan for future family welfare.

Advantages of MyProtection Legacy

Notes:

- The Sum Assured for Basic Insurance will be paid 100% if the Insured dies and the Policy will end.

- Sum Assured for Basic Insurance listed in the Policy Data.

- In the event that the Policyholder does not fulfill one of the Sum Assured Booster Requirements, the Sum Assured for Basic Insurance will be increased by 25% of the Sum Assured for Basic Insurance as stated in the Policy Data ("25% Booster Sum Assured") or no longer fulfills any one Requirement for the Sum Assured Booster, the 50% Booster Sum Assured will be adjusted and changed to a 25% Booster Sum Assured.

- The Benefit of Basic Insurance Premium Waiver is an exemption from paying Basic Insurance Premium beginning on the following Premium Payment Due Date (after the date that Allianz has approved the claim) and continuing through the end of the Premium Payment Period.

Benefit of MyProtection Legacy

Death Benefit & Sum Insured Booster Benefit

If during the Insurance Period the Insured dies, the death benefit will be paid to the Beneficiary in the form of Sum Assured for Basic Insurance

When the Insured reaches 75 years of age, we will provide a Booster Benefit for the Sum Assured in the form of an increase in the Sum Assured for Basic Insurance with the following conditions:- The Sum Assured for Basic Insurance will be increased to 50% of the Sum Assured for Basic Insurance as stated in the Policy Data ("Sum Insured Booster 50%*”) provided that the Policy Holder has met all the criteria for the Requirement for Sum Assured Booster*. Or,

- The Sum Assured for Basic Insurance will be increased to 25% of the Sum Assured for Basic Insurance a stated in the Policy Data if (i) the Policyholder does not meet the Requirements for Sum Assured Booster*; or (ii) has fulfilled the Sum Assured Booster Requirements, and has received the Benefit Sum Assured Booster in the form of an increase in the Sum Assured to a 50% Booster Sum Assured, but after that no longer fulfills one of the Requirements for the Booster Sum Assured.

*Requirements for the Sum Insured Booster;

- The Policyholder chooses to pay premiums by automatic debit via a credit card or savings account;

- Policyholders choose correspondence via email;

- The Policy Holder chooses the electronic version of the Policy Book;

- If the Policy Holder has chosen the method of paying the Premium by automatic debit via credit card or savings account in SPAJ, the Policy Holder does not make changes to the method of payment during the Insurance Period;

- Premiums paid since the Policy Effective Date have never passed the Grace Period; and

- The Policy Holder has never changed the Policy to a Free Premium Policy Accompanied by a Reduced Paid Up

The requirements for the Sum Insured Booster listed in points (i), (ii) and (iii) above must be fulfilled at the time of submitting the SPAJ, as stated in the SPAJ

Benefit of Basic Insurance Premium Extemption

If the Insured suffers from one of the Critical Conditions and the claim for the Basic Insurance Premium Extemption Benefit has been approved by PT Asuransi Allianz Indonesia, PT Asuransi Allianz Indonesia will provide the Basic Insurance Premium Extemption Benefit in the form of exemption from Basic Insurance Premium payment, starting from the next Premium Payment Due Date (after the claim approval date by Us) until the end of the Premium Payment Period.

If the Insured satisfies all of the following requirements, this Basic Insurance Premium Waiver Benefit is applicable- Signs or symptoms of Critical Illness/Condition experienced by the Insured or date of diagnosis of Critical Illness/Condition of the Insured do not occur within 80 days from the Effective Date of the Policy or date of recovery, whichever is later;

- The Insured is diagnosed with a Critical Condition during the Premium Payment Period

- You or the Premium Payer (whichever is compatible) must continue to pay the Premium until the date of approval of this Basic Insurance Premium Waiver Benefit claim

The payment of this Basic Insurance Premium Extemption Benefit does not affect the Sum Insured Booster Benefit. The Death Benefit is For Insured Under 5 Years Old

Specifically for the Insured with Age below and/or up to 5 years old, the Death Benefit in the amount of Sum Assured will be paid according to the following conditions:

The age of the insured at the time of death (years) |

% of the Death Benefit |

≤1 |

20% |

2 |

40% |

3 |

60% |

4 |

80% |

≥5 |

100% |

The Terms and Condition of MyProtection Legacy

| Insured Entry Age |

|

| Policyholder Entry Age | 18 years - there is no maximum Age (nearest birthday). |

| Currency | Rupiah and US Dollar. |

| Insurance Period | Until the Insured Age is 100 years old (nearesr birthday). |

| Premium Payment Period | 5 years, 10 years, dan 15 years. |

| How to Pay Premium | Monthly, Quarterly, Semester and Annual. |

| Premium Leave | Not Available |

| Sum Insured | Minimum : |

| Grace Period | Grace Period: 45 calendar days from the Premium Payment Due Date

|

| Underwriting | Full Underwriting |

| Free Premium Policy Accompanied by a Decrease in Sum Insured (Reduced Paid Up) | Policyholders can apply to Allianz to change the policy to a premium-free policy accompanied by a reduced paid-up in accordance with the following provisions:

|

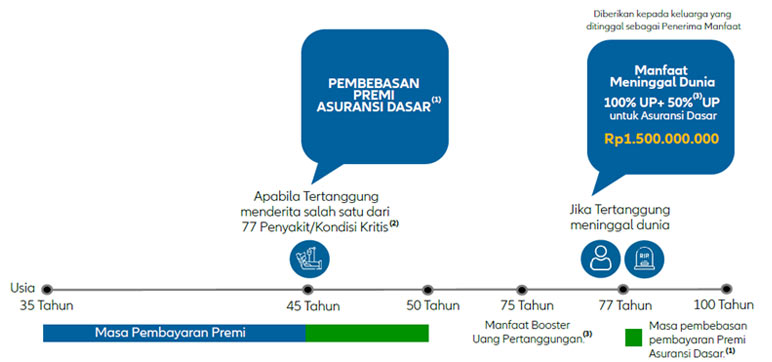

Illustration of MyProtection Legacy's Benefit

| Illustration of MyProtection Legacy's Benefit |

|

Notes:

- The Exemption from payment of Basic Insurance Premium, starting from the next Premium Payment Due Date (the date after the claim approved by Allianz) until the end of the Premium Payment Period.

- If the Insured suffers from one of the 77 Critical Diseases/Conditions as referred to the Special Terms of the Policy, and the claim for Basic Insurance Premium Extemption Benefits has been approved by Allianz.

- A 50% increase of the Sum Assured for Basic Insurance listed in the Policy Data provided after the Policy Holder has met all the criteria for the Requirement for Booster Sum Assured.

- In the event that the Policyholder does not fulfill one of the Sum Assured Requirements, the Sum Assured for Basic Insurance will be increased by 25% of the Sum Assured for Basic Insurance stated in the Policy Data (“25% Booster of Sum Assured”) or no longer fulfills one of the Requirements Sum Assured Booster, 50% Booster of Sum Assured will be adjusted and changed to 25% Booster of Sum Assured.

- Payment of Death Benefit will be deducted in advance by other outstanding obligations (if any) from the Policy Holder to Allianz.

- Payment of the Basic Insurance Premium Extemption Benefit does not affect the Sum Insured Booster Benefit.

About Allianz

About Allianz Group

Allianz is one of the world's largest insurance and asset management providers. Together with customers and sales partners, Allianz is one of the strongest financial communities in the world with operations in 70 countries and supported by 150,000 employees serving more than 100 million individual and corporate customers.

About Allianz in Asia

Allianz has been present in Asia Pacific since 1910 on the coast of China by providing fire and freight insurance. Saat ini, Allianz beroperasi di 16 negara di Asia Pasifik untuk melayani asuransi umum, jiwa, kesehatan, dan manajemen aset. Dengan lebih dari 36.000 staf, Allianz melayani kebutuhan lebih dari 21 juta nasabah di wilayah ini melalui beberapa saluran distribusi.

About Allianz in Indonesia

Allianz started its operations in Indonesia with a representative office in 1981. In 1989, Allianz established PT Asuransi Allianz Utama Indonesia, a general insurance company. Furthermore, Allianz entered the Indonesian life and health insurance market, as well as pension fund by opening PT Asuransi Allianz Life Indonesia in 1996.

In 2006, Allianz Utama and Allianz Life started sharia insurance business. Allianz Health & Corporate Solutions was formed in 2014 to serve the needs of individual and group health insurance. Supported by more than 1,300 employees and a network of more than 34,000 sales professionals as well as bank partners and other distribution channels. Today, Allianz in Indonesia is one of the leading insurance groups in the market trusted to protect more than 8,3 million insured.

Important Notes

- MyProtection Legacy is an insurance product issued by PT Asuransi Allianz Life Indonesia. PT Bank Maybank Indonesia Tbk (“Bank”) only acts as a referrer for MyProtection Legacy.

- MyProtection Legacy is not a Bank product, so the Bank is not responsible for any and all claims and risks arising from managing this product portfolio. MyProtection Legacy is not guaranteed by the Bank and its affiliates and is not included in the scope of the guarantee program objects of the Government of the Republic of Indonesia or Lembaga Penjamin Simpanan (“LPS”). The bank is not responsible for policies issued by PT Asuransi Allianz Life Indonesia. The management of MyProtection Legacy products is carried out by PT Asuransi Allianz Life Indonesia and is the responsibility of PT Asuransi Allianz Life Indonesia.

- PT Bank Maybank Indonesia, Tbk is licensed and supervised by OJK & Bank Indonesia.

- Premiums paid include commissions for the Bank. This brochure is not part of the Policy and is not a form of insurance agreement between PT Asuransi Allianz Life Indonesia and the Customer. The Customer is fully bound by every provision contained in the Policy.

- You can learn more about the terms and conditions, including detailed fees and exclusions, in the General Product and Service Information Summary (RIPLAY) and Personal Product and Service Information Summary (RIPLAY) and Policy.