With 360 – My Portfolio, monitoring assets and loans is easier

- Easy to understand summary

- Complete and specific product categorization

- All assets and loans at Maybank automatically accumulate

- Add assets and loans outside Maybank

- Assets and loans outside Maybank that have been added will automatically accumulate

How to view your total assets and borrowings

|

Login M2U ID App

|

|

|

Click the 360 icon at the top right of the screen to see your portfolio

|

|

|

View your total assets and your total loans. Click to see further details.

|

|

|

See your total assets. Choose one asset category that you own such as Savings, Fixed Deposits and Mutual Fund to see details |

|

|

You can click on each product you own to see further details like account opening and transaction details

|

|

|

See your total loans. Choose one loan category that you have such as Credit Card, Personal Loan and Mortgage to see details

|

|

|

You can click on each product you own to see further details.

|

|

|

Add your own assets or loans outside of Maybank by clicking the yellow + button

|

|

Achieve your goals with auto-debit investments through 360 – Manage Financial Plan

- Set your financial goals

- Get a simulation with automatic calculations based on your dream goals

- Find recommended product according to your goals and risk profile

- There are various choices of investment products, choose your own according to your preferences

How to create and manage your financial plans

|

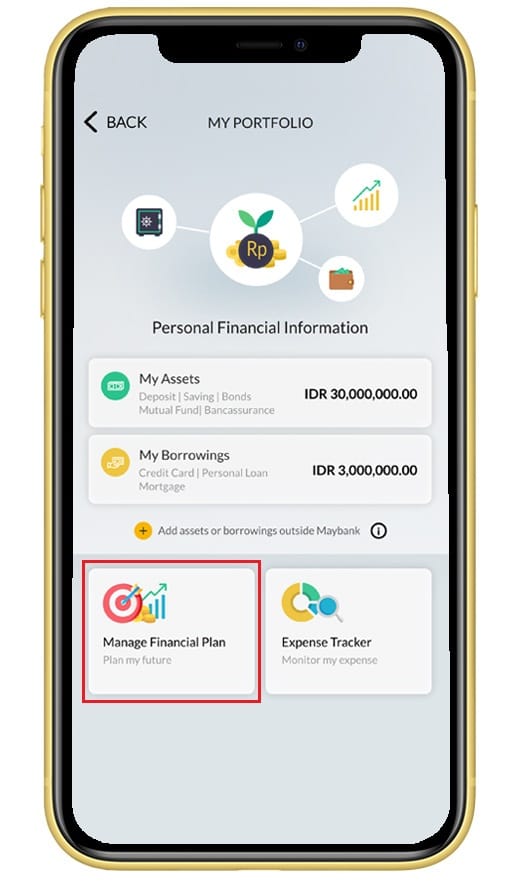

Choose “Manage Financial Plan”

|

|

|

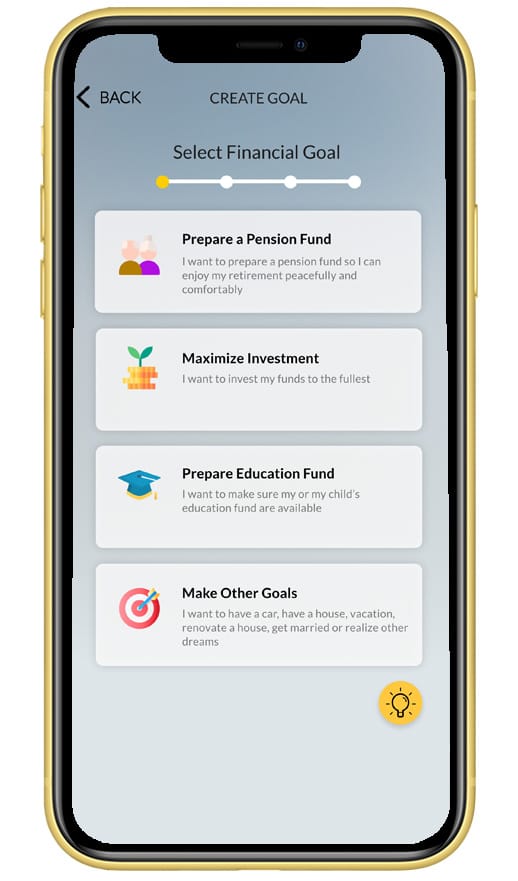

Select a financial goal such as “Prepare a Pension Fund”

|

|

|

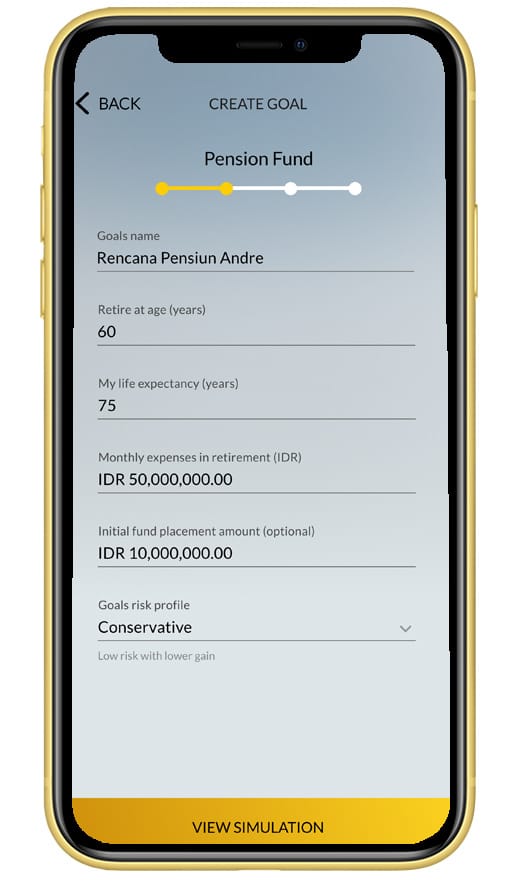

Fill in your information and click “View Simulation”

|

|

|

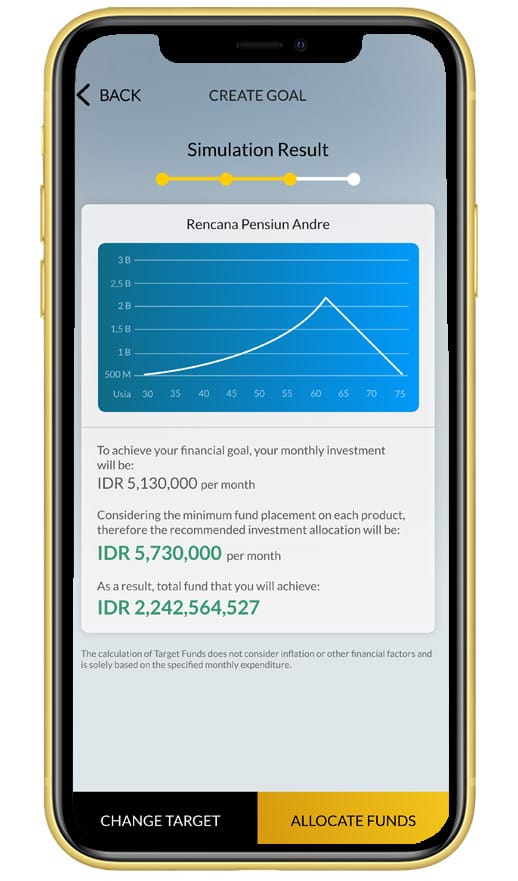

View your Simulation Result then choose “Allocate Funds”. If the simulation result is not as desired, select “Change Target”

|

|

|

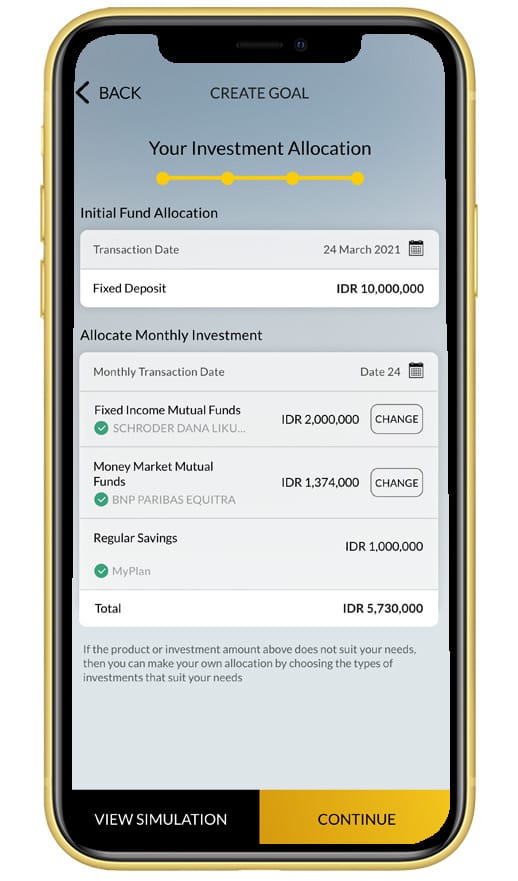

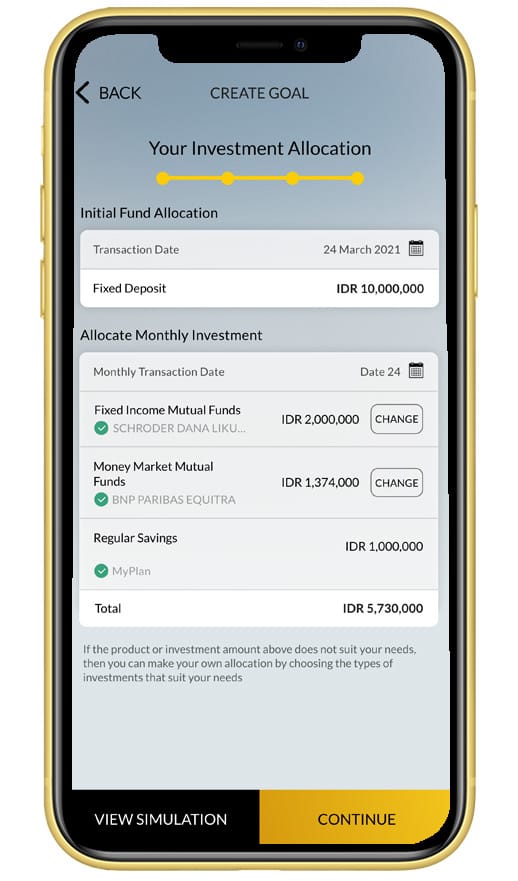

Choose your transaction date for your fixed deposit and your monthly transaction date for your investment. Click “Choose” to select your mutual fund product

|

|

|

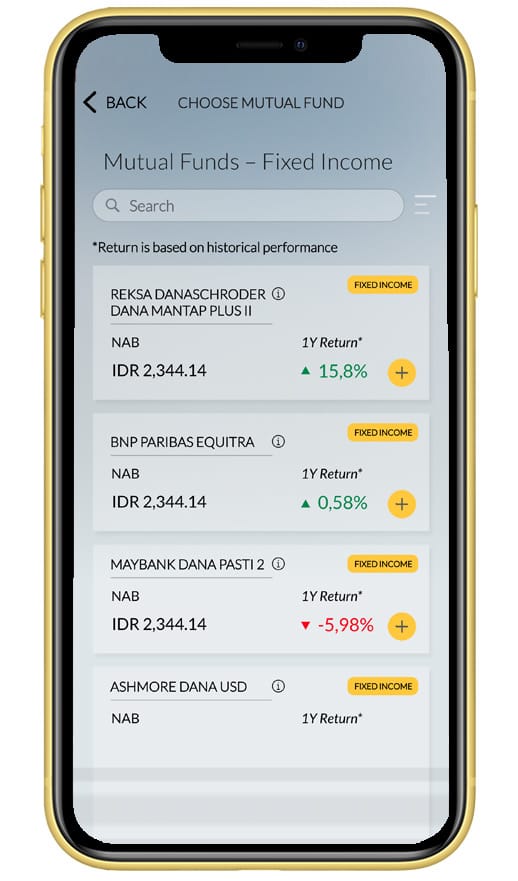

Click the yellow “+” button on the mutual product of your choosing or click the (i) icon to see further product details

|

|

|

Review your investment allocation then click “Continue”

|

|

|

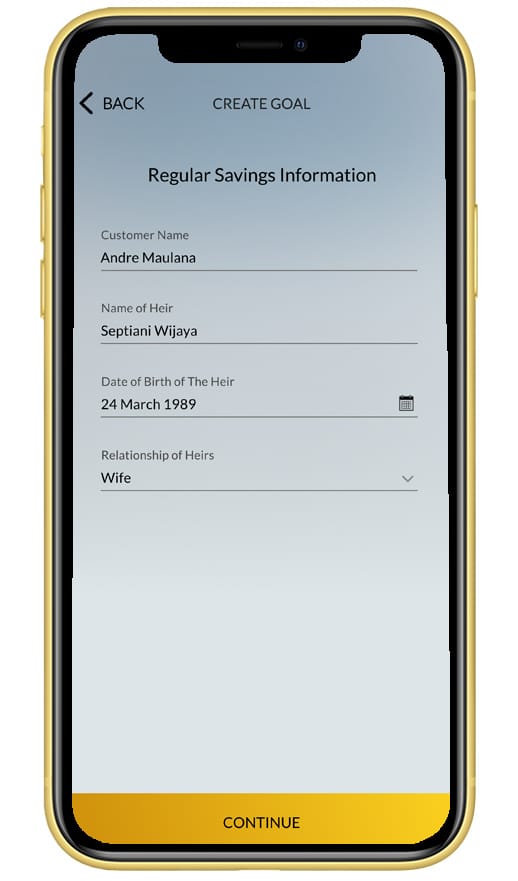

Fill in your personal details for the opening of your Regular Savings, then click “Continue”

|

|

|

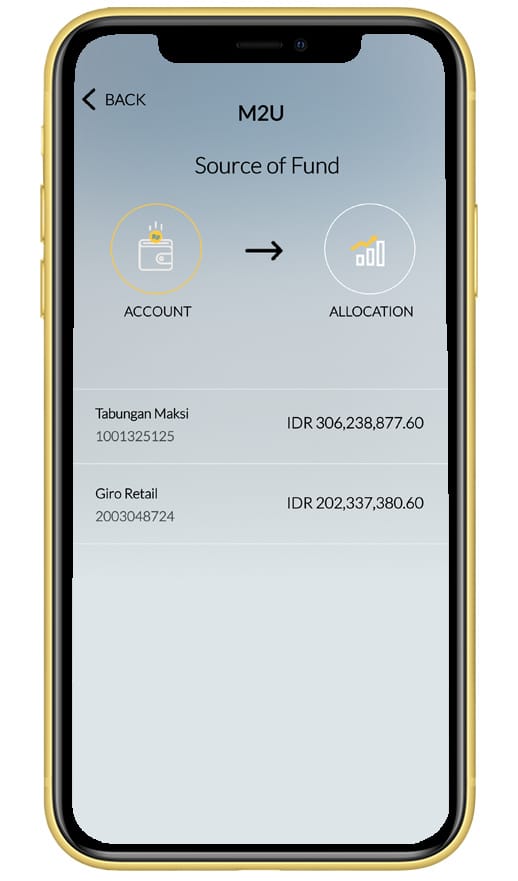

Choose an account to be your source of fund

|

|

|

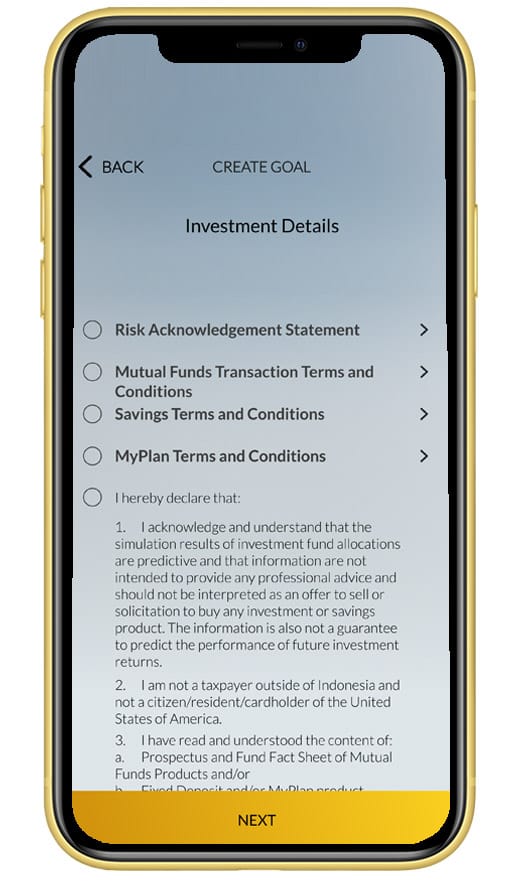

Read and checkmark all the boxes to agree to all terms & conditions

|

|

|

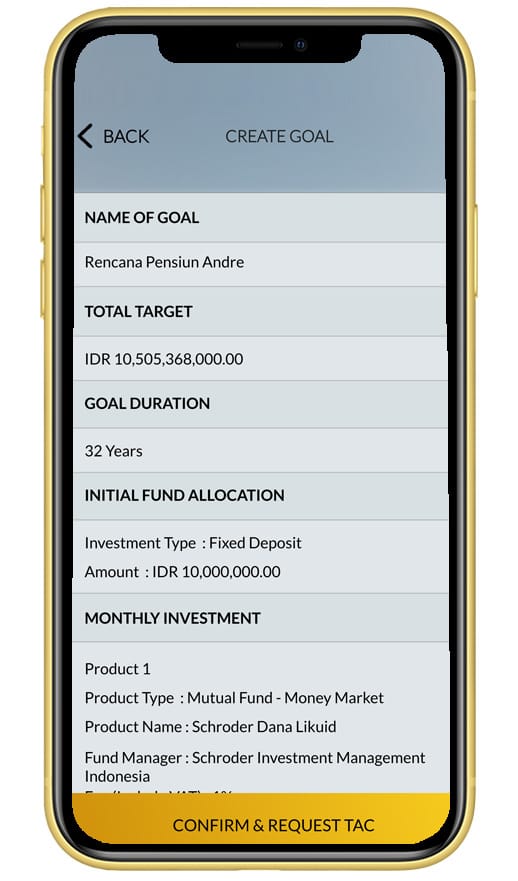

Verify all details then click “Confirm & Request TAC”

|

|

|

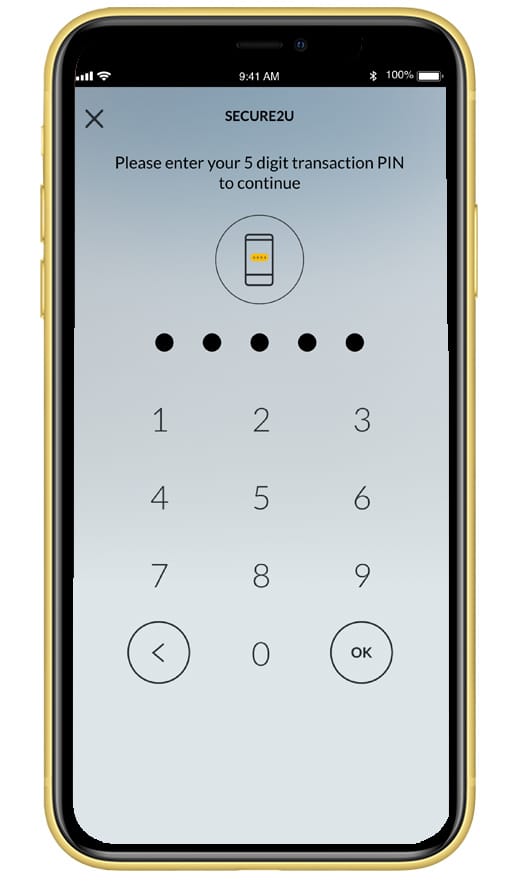

Input your Secure2u passcode / TAC

|

|

|

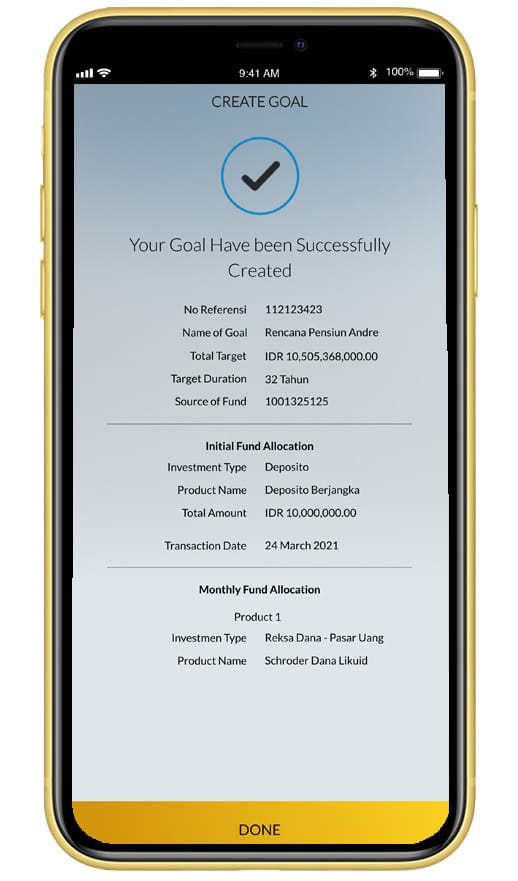

Your goal have been successfully created

|

|

|

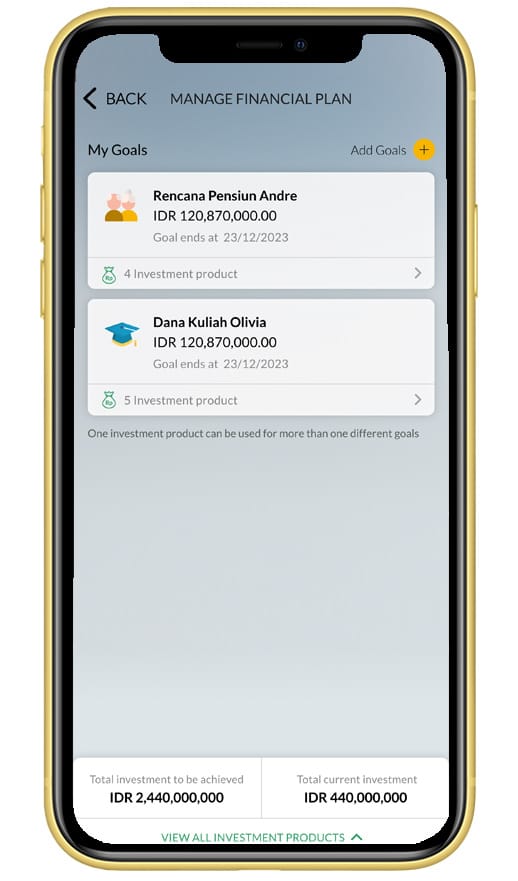

Return to “Manage Financial Plan” menu to see your goals

|

|

Easily track transaction history with 360 – Expense Tracker

- Get automatic summary of all expenses

- All transactions will be recorded neatly and categorized automatically

- If it doesn't match, the transaction category can also be changed as desired

- Use various filters for easy search

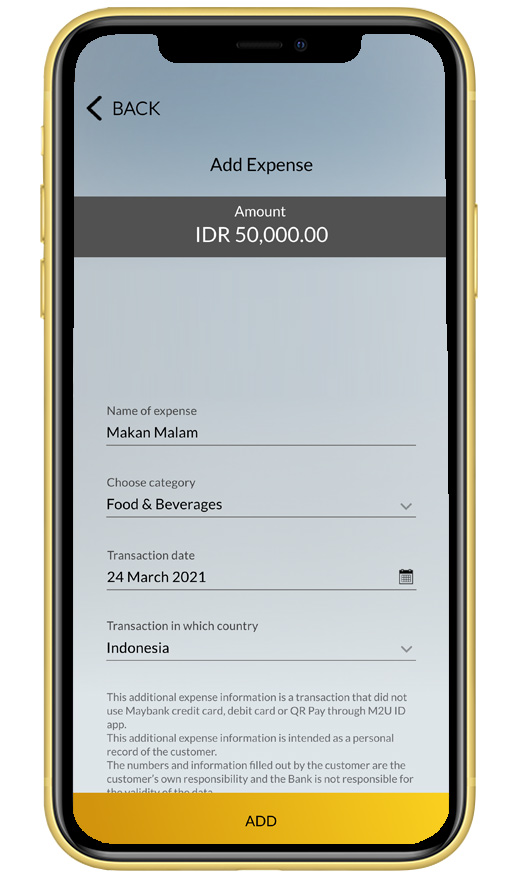

- Add expenses manually as needed

How to manage your expense

|

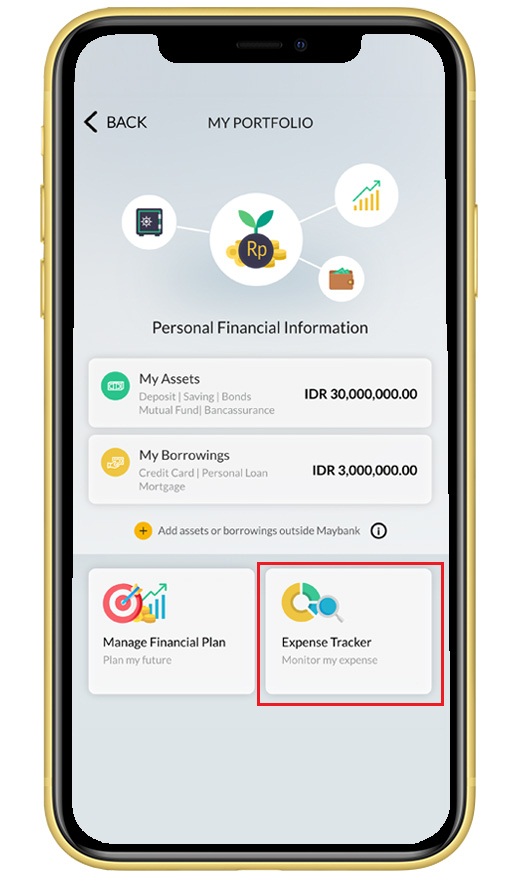

Choose “Expense Tracker”

|

|

|

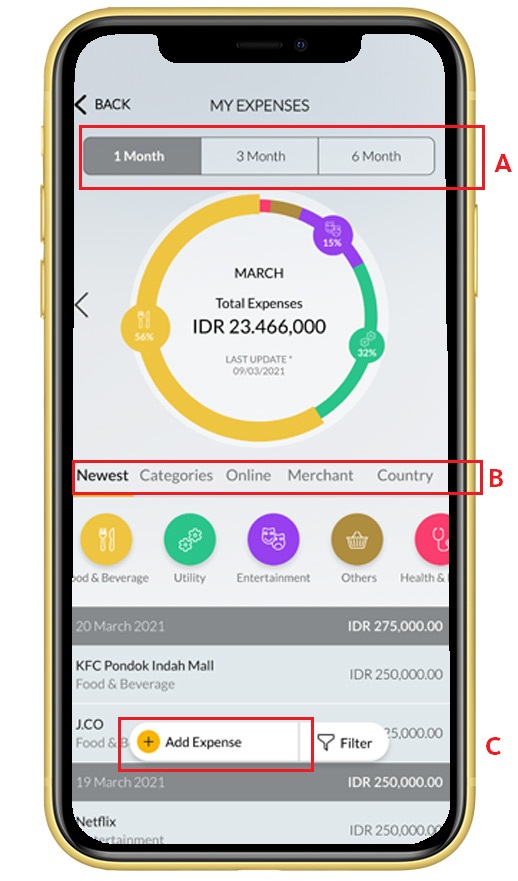

View your total expenses within the past 1 month, 3 months or 6 months. View your newest expenses or your transactions based on their category, online, merchant or country

|

|

|

Transactions that are included are transactions using Maybank credit and debit cards as well as QR Pay transactions via M2U ID App. Click “Add Expense” to add other transactions |

|