HELLO M2U

January-March 2024 Edition

What's New on M2U?

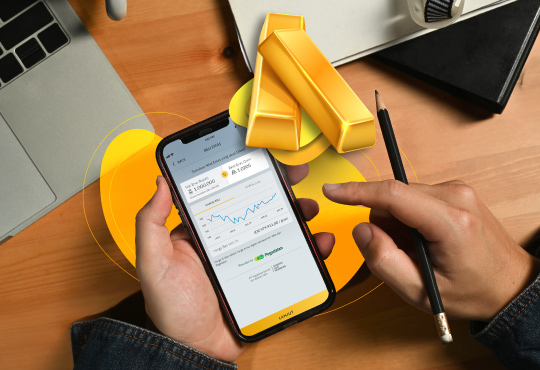

Pegadaian Gold Savings via M2U ID App

Saving gold is now easier and just within your grasp with Pegadaian Gold Savings via M2U ID App.

- Gold transactions in M2U ID App start from Rp 10,000.

- Buy gold periodically

- Pegadaian real-time daily gold value information

Experience the convenience of gold saving now!

MORE DETAIL

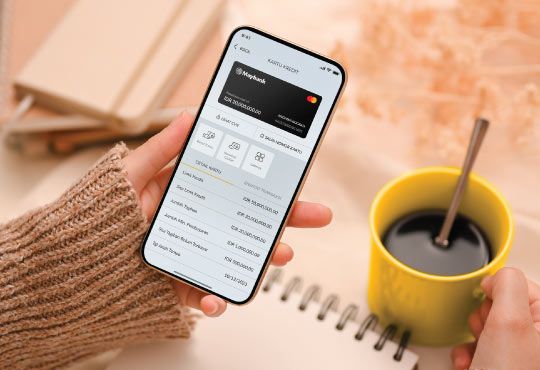

Manage Maybank Credit Cards on the M2U ID App

Enjoy easy access to all Credit Card information with the latest Credit Card Management feature on M2U ID App.

- View CVV and copy credit card number

- View transaction history and convert bills to installments

- Reset PIN and block card

Manage your Credit Cards easily anytime, anywhere! #M2UinAja

MORE DETAIL