MyProtection Waris Syariah

MyProtection Waris Syariah is a Sharia based traditional life insurance product with Regular Contribution payments providing Life and Critical Illness protection benefits. This Product also provides Account Value, the amount is not guaranteed. Your Account Value depends on the investment management by PT Allianz Life Syariah Indonesia.

Advantages of MyProtection Waris Syariah

500% of Sum Assured

Accidental Death Benefit while Insured is on Official Hajj Pilgrimage or Umrah Pilgrimage.

More Detail

Contribution Payment Period options of 5, 10, 15, 20 year or throughout the Insurance Period

Flexible with the options of Contribution Payment Period.

More DetailExplanation:

- As specified in the PolicyData or Endorsement (if any).

- Account Value means the total of the part of the Contribution allocated and invested by Allianz, including the return on the investment. Information on the allocation percentage of Contribution invested by Allianz is set out in the Policy Data (as may be amended from time to time in accordance with the Policy terms). The amount of Account Value is NOT GUARANTEEDby Allianzand shall depend on the return on investment.

- This Accidental Death Benefit shall only be payable to the Beneficiary if the Insured Party passes away within 90 calendar days from the date of the Accident. This Accidental Death Benefit protection shall not be applicable if the Insured Party has reached the Age of 70 years old on the Policy Effective Date or the latest Policy reinstatement date, whicheveris later.

- Public Transport means public transport or mass transport operating under a license from the Government that offers passenger transport services by group travel systems, available for use by the public, managed on a schedule, operated on established routes, and that may charge a fee for each trip.

- Official Hajj Pilgrimage means the process to complete the hajj pilgrimage at the holy land (Saudi Arabia) using the officialquota from the Government of the Republic of Indonesia.

- Umrah Pilgrimage means the process to complete a pilgrimage at the holy land (Saudi Arabia) beginning with an intention of ihram and followed by tawaf (going around the Kaaba), sa’i (running from Safa to Marwa) and ending with tahallul (trimming parts of hair on the head).

- Types of Critical Illness in accordance with the Definitions of 77 Critical Illnesses Protection suffered or experiencedby the Insured Party as specified in the Policy.

- If the Insured Party still alive until the Policy Insurance End Date. Provided that the Policy is still in force. Insurance End Date is as specified in the Policy Data or Endorsement (if any). After payment of the Maturity Benefit to the Participant, the Policy shall terminate.

- Provided that the Policy is in force. Insurance End Date means the date on which the protection under the Policy ends, as specified in the PolicyData.

- Nearest birthday of the Insured Party.

- Maximum amount of Sum Assured and/or Account Value for waqf in the event of the Insured Party’s death, and the claim for Death Benefit or Accidental Death Benefit (as the case may be) approved by Allianz are as stated in the Waqf Application Form and Waqf Promise (wa'ad) or any other terms and conditions to be informed by Allianz and/or the selected waqf institution.

Every Insurance Benefit shall be paid by Allianz after first deducting any overdue Contribution as well as any other obligations (if any).

Benefit of MyProtection Waris Syariah

- Death Benefit

- Subject to the Policy, if during the Insurance Period, the Insured Party passes away not as a result of an Accident or due to an Accident, We shall pay Death Benefit to the Beneficiary in the amount of 2 (two) times the Sum Assured as specified in the Policy Data or Endorsement (if any) plus any Account Value (then accrued) and the Policy shall terminate.

- Payment of this Death Benefit will be reduced by any outstanding Ujrah and Tabarru’ Charge payable by You or Contribution Payor (as the case may be) for the current Policy Year and Your other outstanding obligations to Allianz.

- Accidental Death Benefit

- Subject to the Policy, if during the Insurance Period, the Insured Party passed away:

- due to an Accident, We shall pay an additional sum of 1 (one) time the Sum Assured to the Beneficiary and the Policy shall terminate; or

- due to an Accident when the Insured Party using Public Transport(1) , We shall pay an additional of 2 (two) times the Sum Assured to the Beneficiary and the Policy shall terminate; or

- due to an Accident while on Official Hajj Pilgrimage (2) or Umrah Pilgrimage (3) in Saudi Arabia, We shall pay an additional of 3 (three) times the Sum Assured to the Beneficiary and the Policy shall terminate, under the following terms:

- Official Hajj Pilgrimage commences when the Insured Party (x) enters the hajj dormitory (for Insured Party participating in Regular Hajj programs); or (y) enters the last airport of departure in Indonesia before the Insured Party depart for Saudi Arabia (for Insured Party participating in Special (non-regular) Hajj programs), and each shall end upon return of the Insured Party to the first airport in Indonesia;

- Umrah Pilgrimage commences when the Insured Party arrives at the holy land (Saudi Arabia) to undertake Umrah Pilgrimage and shall end upon return of the Insured Party to the first airport in Indonesia; and

- For the avoidance of doubt, this benefit is not applicable and will not be paid if the Insured Party does not return directly to Indonesia after completing Umrah Pilgrimage or Hajj Pilgrimage but stops by another country to make additional trips outside the Umrah Pilgrimage or Hajj Pilgrimage process for tourism or other purposes and passes away in that country.

- Accidental Death Benefit shall only be payable to the Beneficiary if the Insured Party passes away within 90 (ninety) calendar days from the date of the Accident.

- Sum Assured under this Accidental Death Benefit shall be paid in addition to Death Benefit.

- This Accidental Death Benefit shall terminate on the Policy Anniversary that is closest to the date of the 70th (seventieth) birthday of the Insured Party.

- Payment of this Accidental Death Benefit will be reduced by any outstanding Ujrah and Tabarru’ Charge payable by You or Contribution Payor (as the case may be) for the current Policy Year and Your outstanding obligations to Us.

- Subject to the Policy, if during the Insurance Period, the Insured Party passed away:

- Public Transport means public tranport or mass transport operating under a license from the Government that offers passenger transport services by group travel systems, available for use by the public, managed on a schedule, operated on established routes, and that may charge a fee for each trip.

- Offical Hajj Pilgrimage means the process to complete the hajj pilgrimage at the holy land (Saudi Arabia) using the official quota from the Government of the Republic of Indonesia.

- Umrah Pilgrimage means the process to complete a pilgrimage at the holy land (Saudi Arabia) beginning with an intention of ihram and followed by tawaf (going around the Kaaba), sa’i (running from Safa to Marwa) and ending with tahallul (trimming parts of hair on the head).

- Critical Illness Benefit

- If, prior to the Insurance End Date, the Insured Party suffers from or is diagnosed with one of the Critical Illnesses specified in the Definitions of 77 (seventy-seven) types of Critical Illnesses, We shall pay Critical Illness Benefit in the amount of 1 (one) time the Sum Assured to You.

- Payment of this Critical Illness Benefit will not result in the termination of the Policy. Therefore, to maintain the Policy, You or Contribution Payor (as the case may be) must continue payment of the Regular Contribution in accordance with the Contribution Payment Period selected by You.

- Payment of the Critical Illness Benefit shall only be made 1 (once) to You for any one of the 77 (seventy-seven) types of Critical Illness in accordance with the Definitions of 77 types of Critical Illnesses protection suffered or experienced by the Insured Party; and

- After payment of this Critical Illness Benefit, the Critical Illness Benefit shall automatically terminate

- Maturity Benefit

- Every Insurance Benefit shall be paid by Allianz after first deducting any overdue Contribution as well as any other obligations (if any).

- Perlindungan menjadi tidak berlaku apabila ada hal-hal yang termasuk dalam Pengecualian sebagaimana tercantum dalam Polis.

Notes:

If the Insured Party still alive until the Insurance End Date, We shall pay to You the Maturity Benefit in the form of Account Value accrued at the Insurance End Date. After payment of the Maturity Benefit to You, the Policy shall terminate.

Terms and Conditions of MyProtection Waris Syariah

| Entry Age of the Insured Party |

|

||||||||||||||||||||||||||||

| Entry Age of the Policy Holder | 18 years - no maximum age (nearest birthday). | ||||||||||||||||||||||||||||

| Currency | Rupiah. | ||||||||||||||||||||||||||||

| Contribution Payment Period | 5, 10, 15 & 20 years or equal to Insurance Period. No changes to the Contribution Payment Period shall be made under the Policy. |

||||||||||||||||||||||||||||

| Contribution Payment Method | Regular Contribution (monthly, quarterly, semi-annual and annual). | ||||||||||||||||||||||||||||

| Sum Assured |

Sum Assured

Contribution Minimum:

|

||||||||||||||||||||||||||||

| Underwriting |

Full underwriting |

||||||||||||||||||||||||||||

| Contribution Leave |

Not available |

||||||||||||||||||||||||||||

| Contribution Alocation |

Masa Pembayaran Kontribusi 5 tahun

|

||||||||||||||||||||||||||||

Simulation (Product Illustration)

| Simulation (Product Illustration) MyProtection Waris Syariah | |

|

Insured Party Name : Dani CONTRIBUTION DETAILS

INSURANCE BENEFITS

*Plus Account Value (accrued at the time). |

Insurance Needs : Future legacy planning and financial protection |

Illustrative summary with Contribution Payment Period of 10 years (in Rupiah)

| Policy Year | Annual Contribution (IDR) |

Accumulated Contribution (IDR) | Saving Balance (IDR) |

| 1 | 75.300.000,- | 75.300.000,- | 3.953.300,- |

| 2 | 75.300.000,- | 150.600.000,- | 11.266.800,- |

| 3 | 75.300.000,- | 225.900.000,- | 22.108.600,- |

| 4 | 75.300.000,- | 301.200.000,- | 36.655.10,- |

| 5 | 75.300.000,- | 376.500.000,- | 55.091.500,- |

| 6 | 75.300.000,- | 451.800.000,- | 76.821.700,- |

| 7 | 75.300.000,- | 527.100.000,- | 102.801.000,- |

| 8 | 75.300.000,- | 602.400.000,- | 133.241.900,- |

| 9 | 75.300.000,- | 677.700.000,- | 168.367.400,- |

| 10 | 75.300.000,- | 753.000.000,- | 208.411.800,- |

| 11 | - | 753.000.000,- | 218.832.400,- |

| 12 | - | 753.000.000,- | 229.774.000,- |

| 13 | - | 753.000.000,- | 241.262.700,- |

| 14 | - | 753.000.000,- | 253.325.800,- |

| 15 | - | 753.000.000,- | 265.992.100,- |

| 16 | - | 753.000.000,- | 279.291.700,- |

| 17 | - | 753.000.000,- | 293.256.300,- |

| 18 | - | 753.000.000,- | 307.919.100,- |

| 19 | 753.000.000,- | 323.315.100,- | |

| 20 | 753.000.000,- | 339.480.900,- | |

| 21 | 753.000.000,- | 356.454.900,- | |

| 22 | 753.000.000,- | 374.277.600,- | |

| 23 | 753.000.000,- | 392.991.500,- | |

| 24 | 753.000.000,- | 412.641.100,- | |

| 25 | 753.000.000,- | 433.273.200,- | |

| 26 | 753.000.000,- | 454.936.900,- | |

| 27 | 753.000.000,- | 477.683.700,- | |

| 28 | 753.000.000,- | 501.567.900,- | |

| 29 | 753.000.000,- | 526.646.300,- | |

| 30 | 753.000.000,- | 552.978.600,- | |

| 31 | 753.000.000,- | 580.627.500,- | |

| 32 | 753.000.000,- | 609.658.900,- | |

| 33 | 753.000.000,- | 640.141.800,- | |

| 34 | 753.000.000,- | 672.148.900,- | |

| 35 | 753.000.000,- | 705.756.300,- | |

| 36 | 753.000.000,- | 741.044.100,- | |

| 37 | 753.000.000,- | 778.096.300,- | |

| 38 | 753.000.000,- | 817.001.100,- | |

| 39 | 753.000.000,- | 857.851.200,- | |

| 40 | 753.000.000,- | 900.743.800,- | |

| 41 | 753.000.000,- | 945.781.000,- | |

| 42 | 753.000.000,- | 993.070.100,- | |

| 43 | 753.000.000,- | 1.042.723.600,- | |

| 44 | 753.000.000,- | 1.094.859.800,- | |

| 45 | 753.000.000,- | 1.149.602.800,- | |

| 46 | 753.000.000,- | 1.207.082.900,- |

The above Simulation (Product Illustration) is for general illustrative purpose only.

Notes :

- Account Value amount in the table above is calculated on the assumed return on investment of 5% (five per cent) per year. However, these assumption and amount MAY DIFFER. Actual amount accrued will depend on the return on investment.

- Tabarru’ Charge and Acquisition & Supplementary Ujrah are deducted from Your Contribution (% of Contribution) whose amount depends on the age of the Insured Party and the selected Contribution Payment Period.

Every Insurance Benefit shall be paid by Allianz after first deducting any overdue Contribution as well as any other obligations (if any).

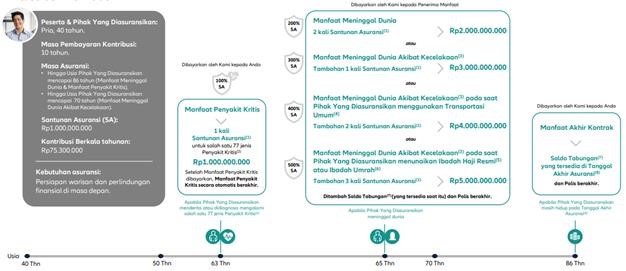

Illustration of the Benefits of MyProtection Waris Syariah

- As specified in the Policy Date or Endorsement (if any).

- Types of Critical Illness in accordance with the Definitions of 77 Critical Illnesses Protection suffered or experienced by the Insured Party as specified in the Policy.

- This Accidental Death Benefit shall only be payable to the Beneficiary if the Insured Party passes away within 90 (ninety) calendar days from the date of the Accident. This This Accidental Death Benefit protection shall not be applicable if the Insured Party has reached the Age of 70 (seventy) years old on the Policy Effective Date or the latest Policy reinstatement date, whichever is later.

- Public Transport means public transport or mass transport operating under a license from the Government that offers passenger transport services by group travel systems, available for use by the public, managed on a schedule, operated on established routes, and that may charge a fee for each trip.

- Offical Hajj Pilgrimage means the process to complete the hajj pilgrimage at the holy land (Saudi Arabia) using the official quota from the Government of the Republic of Indonesia.

- Umrah Pilgrimage means the process to complete a pilgrimage at the holy land (Saudi Arabia) beginning with an intention of ihram and followed by tawaf (going around the Kaaba), sa’ee (running from Safa to Marwa) and ending with tahallul (trimming parts of hair on the head).

- Total of the part of the Contribution allocated and invested by Us, including return on investment. 8) Provided that the Policy is in force. Insurance End Date means the date on which the protection under the Policy ends, as specified in the Policy Data.

Every Insurance Benefit shall be paid by Allianz after first deducting any overdue Contribution as well as any other obligations (if any).

About Allianz

About Allianz Group

Allianz Group is a leading insurance and asset management company in the world with over 122 million individual and corporate customers in more than 70 countries. Allianz customers benefit from a wide range of individual and group insurance services, ranging from property, life, and health insurance to global credit insurance and business insurance assistance services. Allianz is one of the largest investors in the world, with customer insurance assets under management exceeding 714 billion Euros. Meanwhile, our asset managers, PIMCO and Allianz Global Investors, manage an additional 1.7 trillion Euros of third-party assets. Thanks to systematic integration of ecological and social criteria into business processes and investment decisions, Allianz holds a leading position among insurance companies in the Dow Jones Sustainable Index. In 2022, the Allianz Group had 159,000 employees and achieved total revenues of 152.7 billion Euros, with an operating profit of 14.2 billion Euros.

About Allianz in Asia

Asia is one of the core growth regions for Allianz, characterized by cultural diversity, languages, and customs. Allianz has been present in Asia since 1910, providing fire and maritime insurance in coastal cities of China. Currently, Allianz is active in 15 markets in the region, offering a wide range of insurance products with core businesses in property insurance, life insurance, protection and health solutions, and asset management. With over 36,000 employees, Allianz serves the needs of more than 21 million customers in this region through various distribution channels and digital platforms.

About Allianz in Indonesia

Allianz began its business in Indonesia by opening a representative office in 1981. In 1989, Allianz established PT Asuransi Allianz Utama Indonesia, a general insurance company. Subsequently, Allianz entered the life, health, and pension insurance business by founding PT Asuransi Allianz Life Indonesia in 1996. In 2006, Allianz Utama and Allianz Life ventured into the Shariah insurance business. In 2023, PT Asuransi Allianz Life Syariah Indonesia officially commenced operations as a separate entity providing Shariah-based insurance protection and financial risk management. Today, Allianz Indonesia is supported by over 1,000 employees and more than 40,000 marketers, backed by a network of banking partners and other distribution partners. Currently, Allianz is one of the leading insurance companies in Indonesia, trusted to protect over 10 million policyholders.

PT Asuransi Allianz Life Indonesia is licensed and supervised by Otoritas Jasa Keuangan, and its Marketers hold a license from the Indonesian Life Insurance Association.

Important Notes:

- PT Bank Maybank Indonesia Tbk (“Bank”) is a Bank licenced and supervised by the Indonesian Indonesian Financial Services Authority (Otoritas Jasa Keuangan) & Bank Indonesia.

- PT Asuransi Allianz Life Syariah Indonesia is licensed and supervised by the Indonesian Financial Services Authority (Otoritas Jasa Keuangan), and its Marketing Personnel holds the license from the Indonesian Sharia Insurance Association (Asosiasi Asuransi Syariah Indonesia).

- Contribution paid includes the commission for the Bank.

- A comprehensive explanation of insurance protection may be found in the Policy. The insurance protection is subject to the Exclusions stated in the Policy, which outline the specific circumstances or events that are not protected by the Policy.

- PT. Asuransi Allianz Life Syariah Indonesia shall inform You of any changes in terms as set out in the Policy no later than 30 (thirty) business days before the effective date of such changes to the terms. The 30 (thirty) business day period shall not apply to changes by Us for compliance with the applicable laws and regulations

- MyProtection Waris Syariah is an insurance product issued by PT Asuransi Allianz Life Syariah Indonesia. The Bank may only act as referrer for MyProtection Waris Syariah. MyProtection Waris Syariah is not a product of the Bank and therefore the Bank shall not be responsible for any and all claims and any risks associated with the Policy issued by PT Asuransi Allianz Life Syariah Indonesia. MyProtection Waris Syariah is not protected by the Bank and its affiliates and is not covered by the Government of the Republic of Indonesia or Deposit Insurance Corporation (“LPS”). The use of the name, logo and other indication of the Bank in the General Summary of Product and Service Information (RIPLAY) shall not be construed as the insurance product being a product of the Bank

- PT. Asuransi Allianz Life Syariah right reserve the right to reject Your Policy application if it fails to meet the requirements or to comply with regulations