MyProtection Future

MyProtection Future is a traditional life insurance product that requires with Regular Basic Premium payments for 3 years, offering a range of benefits, including :

- Death benefit

- Sum Assured Booster

- Cash value

- Maturity Benefit

With MyProtection Future, you not only protect yourself but also plan your future wisely. Enjoy peace of mind and maximize your legacy for your loved ones.

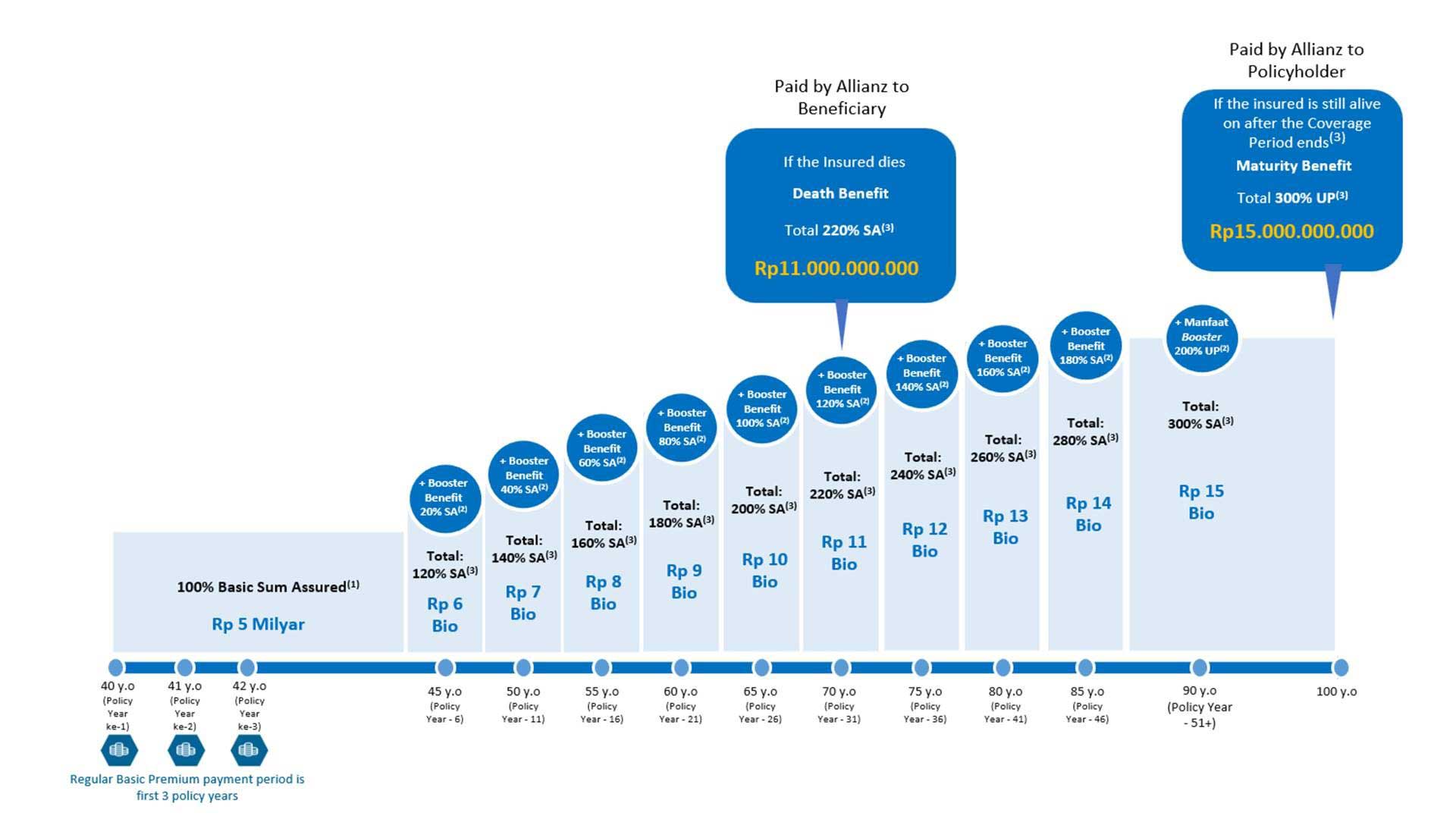

Advantages of MyProtection Future

Notes:

(1) The Basic Coverage Amount is as stated in the Policy Data or Endorsement (if any).

(2) The Sum Assured Booster Benefit is an addition of 20% of the Initial Basic Sum Assured Amount (as stated in the Policy Data), which Allianz will provide every 5 Policy Years after the Policy Start Date. Information regarding the value of the Death Benefit, including Basic Sum Assured and Sum Assured Booster provided by Allianz is stated in the Policy Data.

(3) The Maturity Date is as stated in the Policy Data.

(4) In accordance with the applicable product terms, every Insurance Benefit will be paid by Allianz after deducting any outstanding obligations (if any).

Benefits of MyProtection Future

- Death Benefit

Subject to the General Terms of the Policy, if the insured dies during the coverage period, PT Asuransi Allianz Life will pay the Death Benefit to the beneficiary, consisting of:- Basic Sum Assured with the following terms: coverage as stated in the Policy Data or Endorsement (if any).

- Sum Assured Booster with the following terms:

- 20% of the Basic Sum Assured every 5 policy years after the policy start date.

- Maximum Sum Assured Booster is 200% of the Basic Sum Assured, as explained in the table below:

Policy Year Booster Coverage Benefit 1-5 0% 6-10 20% 11-15 40% 16-20 60% 21-25 80% 26-30 100% 31-35 120% 36-40 140% 41-45 160% 46-50 180% 51+ 200%

Details regarding the Death Benefit, including Basic Sum Assured and Sum Assured Booster, are stated in the Policy Data.

- Maturity Benefit

If the insured is still alive on the Coverage Period ends, as stated in the policy data, the policy will terminate, and PT Asuransi Allianz Life will pay the Maturity benefit to the policyholder based on the value stated in the policy data.

Every insurance benefit will be paid after first deducting any outstanding obligations (if any).

(Coverage will become void if there are circumstances included in the exclusions as stated in the policy.)

Terms and Conditions of MyProtection Future

| Entry Age of the Insured |

Insured : 18 - 70 years (nearest birthday). Policyholder : 18 years and above (no maximum age, nearest birthday) |

||||||||||

| Currency | Indonesian Rupiah (IDR). | ||||||||||

| Coverage Period | Until the insured reaches 100 years old (nearest birthday). | ||||||||||

| Premium Payment Period | Basic periodic premium for the first 3 policy years. | ||||||||||

| Premium Payment Mode |

The options for Regular Basic premium payments are monthly, quarterly, semi-annually, and annually.

|

||||||||||

| Minimum Premium |

|

||||||||||

| The Minimum Basic Sum Assured for Death Benefit is : |

IDR3,000,000,000.

|

||||||||||

| Modal Factors for Regular Premium Mode Options |

|

||||||||||

| Underwriting | Full Underwriting. | ||||||||||

| Premium Holiday | Not available. |

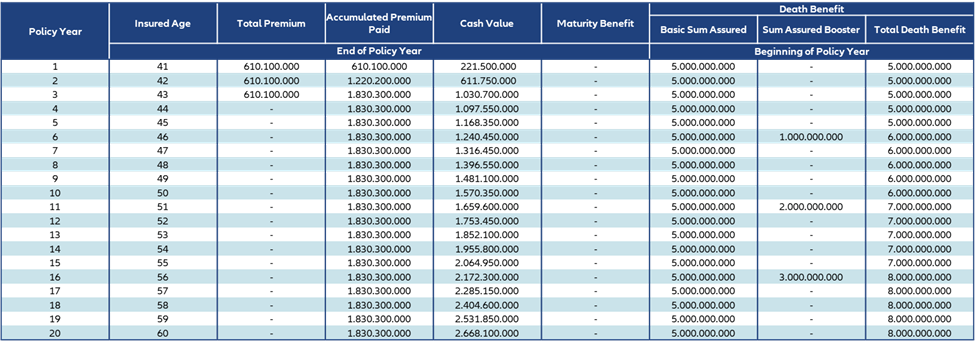

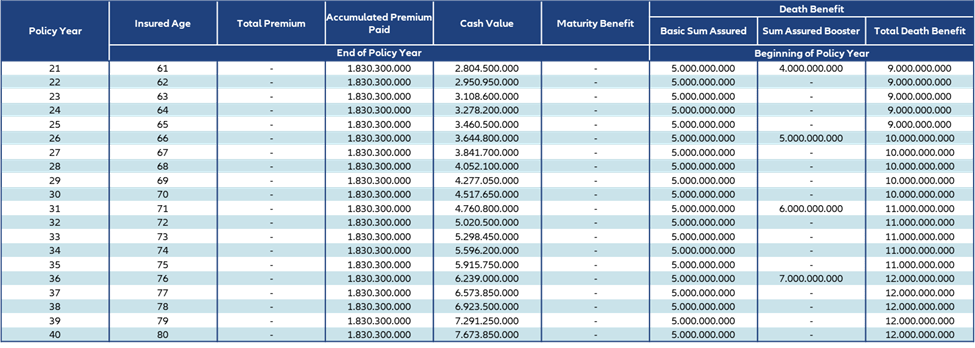

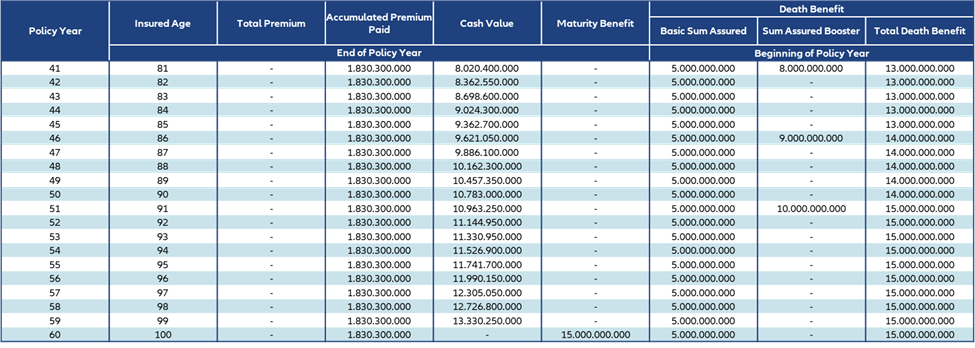

Scenario (Product Illustration)

|

Name of the Insured Party: Toni

Maturity benefit: IDR15,000,000,000.

|

Needs: Increasing preparation of inheritance for the future well-being of the family. |

Illustration of Death Benefit and Maturity Benefit from the Premiums Paid (in Rupiah)

Benefit Illustration of MyProtection Future

Note:

(1) The Basic Sum Assured as stated in the Policy Data or Endorsement (if any).

(2) The Booster Sum Assured benefit is an addition of 20% (twenty percent) of initial Basic Sum Assured (as stated in the Policy Data), which PT Asuransi Allianz Life will provide every 5 (five) years after the Policy Effective Date. Information regarding the value of the Death Benefit, including Basic Sum Assured and Sum Assured Booster provided by Allianz is stated in the Policy Data.

(3) The total Death Benefit from Basic Sum Assured plus Booster Sum Assured.

(4) End of Coverage Period as stated in the Policy Data. Each Insurance Benefit will be paid after deducting any other obligations (if any).

About Allianz

About Allianz Group

Allianz Group is a leading insurance and asset management company in the world with over 122 million individual and corporate customers in more than 70 countries. Allianz customers benefit from a wide range of individual and group insurance services, ranging from property, life, and health insurance to global credit insurance and business insurance assistance services. Allianz is one of the largest investors in the world, with customer insurance assets under management exceeding 714 billion Euros. Meanwhile, our asset managers, PIMCO and Allianz Global Investors, manage an additional 1.7 trillion Euros of third-party assets. Thanks to systematic integration of ecological and social criteria into business processes and investment decisions, Allianz holds a leading position among insurance companies in the Dow Jones Sustainable Index. In 2022, the Allianz Group had 159,000 employees and achieved total revenues of 152.7 billion Euros, with an operating profit of 14.2 billion Euros.

About Allianz in Asia

Asia is one of the core growth regions for Allianz, characterized by cultural diversity, languages, and customs. Allianz has been present in Asia since 1910, providing fire and maritime insurance in coastal cities of China. Currently, Allianz is active in 15 markets in the region, offering a wide range of insurance products with core businesses in property insurance, life insurance, protection and health solutions, and asset management. With over 36,000 employees, Allianz serves the needs of more than 21 million customers in this region through various distribution channels and digital platforms.

About Allianz Indonesia

Allianz began its business in Indonesia by opening a representative office in 1981. In 1989, Allianz established PT Asuransi Allianz Utama Indonesia, a general insurance company. Subsequently, Allianz entered the life, health, and pension insurance business by founding PT Asuransi Allianz Life Indonesia in 1996. In 2006, Allianz Utama and Allianz Life ventured into the Shariah insurance business. In 2023, PT Asuransi Allianz Life Syariah Indonesia officially commenced operations as a separate entity providing Shariah-based insurance protection and financial risk management. Today, Allianz Indonesia is supported by over 1,000 employees and more than 40,000 marketers, backed by a network of banking partners and other distribution partners. Currently, Allianz is one of the leading insurance companies in Indonesia, trusted to protect over 10 million policyholders.

Important Notes:

- PT Bank Maybank Indonesia Tbk (“the Bank”) is a licensed bank regulated by the Financial Services Authority and Bank Indonesia.

- PT Asuransi Allianz Life Indonesia is licensed and regulated by the Financial Services Authority, and its sales agents hold licenses from the Indonesian Life Insurance Association.

- The premiums paid include commissions for the Bank.

- Detailed insurance coverage is outlined in the Policy. Insurance coverage is subject to the Exclusions listed in the Policy, which specify what is not covered under the Policy.

- PT Asuransi Allianz Life Indonesia will inform you of any changes to the provisions in the Policy no later than 30 (thirty) business days before the changes take effect. The 30 (thirty) business days notice period does not apply if the changes are made by PT Asuransi Allianz Life Indonesia to comply with applicable laws and regulations.

- MyProtection Future is an insurance product issued by PT Asuransi Allianz Life Indonesia. The Bank acts solely as a reference provider for MyProtection Future. MyProtection Future is not a Bank product, and the Bank is not responsible for any claims or risks associated with the Policy issued by PT Asuransi Allianz Life Indonesia. MyProtection Future is not guaranteed by the Bank or its affiliates and is not covered under the Government of the Republic of Indonesia's guarantee program or the Deposit Insurance Corporation (LPS). The use of the Bank's name, logo, and other attributes in the General Product and Service Information Summary (RIPLAY) should not be interpreted as indicating that this insurance product is a Bank product.