MyProtection Bijak II

MyProtection Bijak II is a Sharia-based life insurance product with periodic contributions that provides a combination of life protection as well as investment with a choice of sub-funds to suit your needs.

Advantages of MyProtection Bijak II

**Investment fund to purchase units according to the percentage allocation of contribution to investment based on the policy and according to the choice of the sub fund.

Benefit of MyProtection Bijak II

- Death Benefit

If during the insurance period the insured party dies, then PT Asuransi Allianz Life will pay the death benefit to the beneficiary in the amount of the insurance compensation as stated in the policy data or the endorsement, if any, plus investment benefits in the form of the balance of the investment value in the policy up to with the date the death benefit claim is approved. - Investment Benefit

PT Asuransi Allianz Life will pay this benefit in the amount of the investment value balance contained in this policy in case :- The Insured Party dies during the Insurance Period, to the Beneficiary; or

- The Insured Party lives until the end of the Insurance Period, to Participants; or

- The Participant's Policy is canceled, where there is still Investment value left after deducting the Policy Redemption Fee (if applicable) and other obligations (if any) to the Participant.

- End of Contract Benefit

If the Insured Party is still alive until the Insurance End Date for Basic Insurance, PT Asuransi Allianz life will pay the Investment Benefit in the form of the entire balance of the Investment Value (if any) to the Participant.

Each Insurance Benefit will be paid by PT Asuransi Allianz Life after first deducting other obligations (if any).

Allocation of MyProtection Bijak II Contribution

Contributions that participants or contribution payers (whichever is appropriate) pay will be allocated as investment funds in accordance with the following conditions.

- Periodic basic contribution will be entirely allocated as an Investment fund for the establishment of periodic basic contribution Investment Value.

- Periodic top up Contribution and single top up contribution will be allocated as investment fund for the establishment of top up contribution investment value of 95% of the periodic top up contribution and/or single top up contribution.

- The contribution allocation provisions mentioned above will be subject to the general policy terms and conditions.

4 Benefit Choices of MyProtection Bijak II

| Bijak Investasi Maximum Investment potential plan protection. |

Bijak Edukasi Protection of the child's education fund plan in the future. |

Bijak Pensiun Future retirement plan protection. |

Bijak Proteksi Maximum protection of lifestyle & assets. |

|

| Basic Benefits 100% Life Insurance Compensation + Potential Investment Value (not guaranteed) if the Insured Party dies.* |

✓ | ✓ | ✓ | ✓ |

| Additional Benefit Options Compensation for Death & Total Permanent Disability Due to Accident (ADDB Syariah). Total Permanent Disability Benefit Due to Illness/Accident (TPD Syariah/TPD Accelerated Syariah). Medical Assistance Services (Medical Assistance). |

- - - |

- - - |

+ or + or + |

+ or + or + |

|

Compensation for 49 Types of Critical Illness (CI Plus Syariah/CI Accelerated Sharia). |

- | + or |

+ or |

+ or |

| Compensation for 100 Critical Illness Conditions (CI 100 Sharia). | - | + | + | + |

| Daily Cash Benefit at the Hospital (Flexicare Family Syariah). | - | + | - | - |

| Reimbursement of Hospital Treatment Costs (AlliSya H&S Care+). | - | - | - | + |

| Sharing Contribution Exemption Participant/Spouse: Passed Away (Payor Protection Syariah, Spouse Payor Protection Syariah) Diagnosed with Critical Illness (Payor Benefit Syariah, Spouse Payor Benefit Syariah). |

- - |

+ or + |

- - |

- - |

+ Optional Additional benefits in each protection plan

* Life protection up to the age of the Insured Party 100 years

Notes :

In the event that you submit to PT Asuransi Allianz Life a request not to impose an elimination period and/or a waiting period (whichever is appropriate) in relation to the additional benefits that you have chosen ("Additional Application"), you, the prospective Insured Party, the prospective Contribution Payer and /or the prospective Contributor Spouse (whichever is appropriate) must meet additional requirements that PT Asuransi Allianz Life will determine in accordance with Our underwriting policy. PT Asuransi Allianz Life reserves the right to refuse an Additional Application submitted in the event that You, the prospective Insured Party, the prospective Contributor and/or the potential Contributor Spouse (as appropriate) do not meet the requirements of Our underwriting policy.

Choice of Waqf Features

Available with the maximum that can be donated:

- 45% of the value of the Insurance Benefit.*

- 30% of the investment value balance.*

*) Maximum value of insurance compensation (including Insurance compensation for additional insurance (if any)) and/or investment balance, respectively, at the time the death benefit claim is approved by Allianz.

Notes :

- The Participant, the insured and the beneficiary must complete and sign the Waqf application Form and Waqf pledge (wa'ad) and submit the form to Allianz.

- Participants, insured parties and beneficiaries must comply with all terms and conditions stated in the Waqf application form and Waqf promise (wa'ad) or other terms and conditions that will be informed by Allianz and/or the selected waqf institution.

- When the Insured person dies, and the claim for the death benefit (including additional insurance (if any)) is approved by Allianz :

- Insurance compensation and/or investment value donated will be paid by Allianz to the waqf institution chosen by the participant according to the most recent data and/or information recorded in the Allianz system and in accordance with the procedures applicable to Allianz.Insurance compensation and/or investment value donated will be paid by Allianz to the waqf institution chosen by the participant according to the most recent data and/or information recorded in the Allianz system and in accordance with the procedures applicable to Allianz.

- The amount of insurance compensation received by the beneficiary is as stated in the Sharia SPAJ or the latest recorded in the Allianz system based on the changes submitted by the participant and Allianz agrees from time to time in accordance with the procedures in force at Allianz;

- Total investment value that will be received by the beneficiary is equal to the remaining investment value (after deducting the amount donated). In the event that there is more than 1 Beneficiary, the amount of investment value that will be received by each beneficiary, after being deducted by the amount donated, will be calculated proportionally according to the percentage of insurance compensation for each Beneficiary listed in SPAJ Syariah or the latest recorded in the Allianz system based on the changes that the Participant proposes and Allianz agrees from time to time in accordance with the procedures in force at Allianz.

- The waqf application (along with its amendments, if any) that has been approved by Allianz will be included in the policy data and/or endorsement.

Terms and Condition of MyProtection Bijak II

| Insured Entry Age | 1 month - 70 years old (nearest birthday). | ||||||||||||||||||||

| Policy Holder Entry Age | Minimum 18 years old (nearest birthday). | ||||||||||||||||||||

| Currency | Rupiah. | ||||||||||||||||||||

| Insurance Period | Until the Insured reaches the age of 100 years. | ||||||||||||||||||||

| Contribution Payment Period | Up to the Insured Age 99 years old. | ||||||||||||||||||||

| Contribution Payment Method |

The premium payment scheme is periodic premium (Annually, Semester, Quarterly, and Monthly). |

||||||||||||||||||||

| Contribution | Minimum Periodic Basic Premium:

The amount of Periodic Basis Contribution cannot be changed (added/decreased) Minimum Periodic Top Up Contribution :

Minimum Single Top Up Contribution IDR1,000,000 Maximum - Total Premium more than IDR2,000,000,000 |

||||||||||||||||||||

| Compensation |

Minimum : Maximum : Maximum Insurance Benefit for children (up to 17 years old): IDR3,000,000,000. |

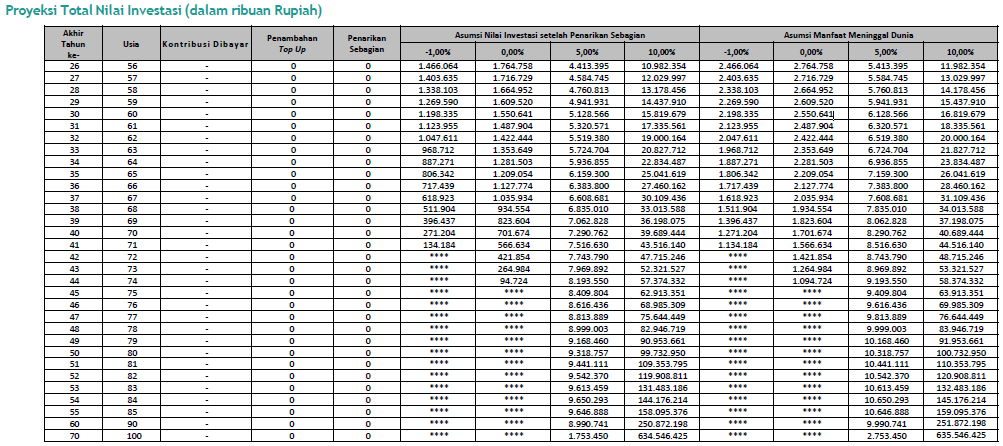

Product Illustration of MyProtection Bijak II

| Product Illustration of MyProtection Bijak II | |

Name of the Insured Party : Jonas

CONTRIBUTION DETAILS

|

Need for a financial plan: |

Investment Level Assumptions per Year: -1%, 0%, 5%, and 10%

- If the ***** mark appears on the Investment Value Projection Table ", this indicates that, based on the assumption of the investment level that was set by PT Asuransi Allianz Life, your investment value is not sufficient to pay for the Ujrah specified in the Policy and the Policy will end. You are advisable to always make Contribution payments until the Insured Party is 99 years old so that your Investment Value is maintained and sufficient to pay the Ujrah specified in the Policy.

- The illustration of the benefits above is based on the assumed level of investment per year from the sub-fund allocation you choose above.

- The illustration or projection of the Investment Value above is not binding and is not an insurance agreement and is not part of the Policy.

- The illustration or projection of investment value above is not guaranteed and may change from time to time, depending on the performance of the sub fund selected by you and/or the potential for worsening of investment returns.

- Investment value is the value of the total basic periodic contribution unit, periodic top up contribution unit and single top up contribution unit that has been formed in the Policy based on the unit price at a certain time.

- The investment value can be less than the amount of the contribution paid or the portion of the contribution invested.

- Investment value is not guaranteed, it can increase or decrease depending on the performance of the sub-fund chosen by you and is inseparable from investment risk. The past performance of a sub-fund does not reflect the future performance of that sub-fund.

- The illustration above has taken into account the Acquisition and Maintenance Ujrah, Insurance Contribution, Ujrah Risk Management Ujrah Administration of Fund Transfer Ujrah, Policy Redemption Ujrah, Contribution Leave Ujrah and Investment Fund Management Ujrah whose frequency and imposition are as stated in Know Ujrah related to your policy.

- Investment value projection above is only an illustration and does not describe the actual investment performance.

- Death benefit is life insurance compensation and potential investment value that is given when the Insured party dies during the Insurance period and active policy status.

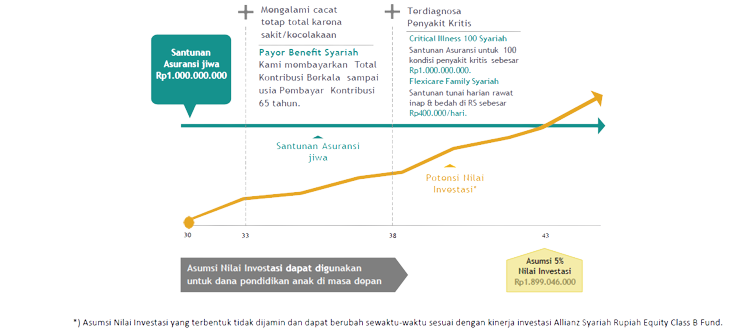

| Benefits illustration of MyProtection Bijak II | ||

|

Investment rate assumption per year 5% With a 100% placement in Allianz Syariah Rupiah Equity Class B Fund |

Jonas 30 years, does not smoke company manager Child: Dylan, age 5 years |

Financial plan requirements: Bijak Edukasi Total Periodic Contribution : IDR120,000,000 per year for 20 years (Regular Basic Contribution : IDR40,000,000 + Periodic Top Up Contribution : IDR80,000,000) |

*) Assumed Investment Value formed is not guaranteed and can change at any time according to the investment performance of the Allianz Syariah Rupiah Equity Class B Fund.

About Allianz

About Allianz Group

Allianz is one of the world's largest insurance and asset management providers. Together with customers and sales partners, Allianz is one of the strongest financial communities in the world with operations in 70 countries and supported by 150,000 employees serving more than 100 million individual and corporate customers.

About Allianz in Asia

Allianz has been present in Asia Pacific since 1910 on the coast of China by providing fire and freight insurance. Currently, Allianz operates in 16 countries in Asia Pacific to provide general insurance, life, health and asset management. With more than 36,000 staff, Allianz serves the needs of more than 21 million customers in the region through several distribution channels.

About Allianz in Indonesia

Allianz started its operations in Indonesia with a representative office in 1981. In 1989, Allianz established PT Asuransi Allianz Utama Indonesia, a general insurance company. Furthermore, Allianz entered the Indonesian life and health insurance market, as well as pension fund by opening PT Asuransi Allianz Life Indonesia in 1996.

In 2006, Allianz Utama and Allianz Life started sharia insurance business. Allianz Health & Corporate Solutions was formed in 2014 to serve the needs of individual and group health insurance. Supported by more than 1,300 employees and a network of more than 34,000 sales professionals as well as bank partners and other distribution channels. Today, Allianz in Indonesia is one of the leading insurance groups in the market trusted to protect more than 8,3 million insured.

PT Asuransi Allianz Life Indonesia is licensed and supervised by Otoritas Jasa Keuangan, and its Marketers hold a license from the Indonesian Life Insurance Association

Important Notes:

- MyProtection Bijak II is an insurance product issued by PT Asuransi Allianz Life Indonesia. PT Bank Maybank Indonesia Tbk (“Bank”) only acts as a referrer for MyProtection Bijak II.

- MyProtection Bijak II is not a Bank product, so the Bank is not responsible for any and all claims and risks arising from managing this product portfolio. MyProtection Bijak II is not guaranteed by the Bank and its affiliates and is not included in the scope of the guarantee program objects of the Government of the Republic of Indonesia or Lembaga Penjamin Simpanan (“LPS”). The bank is not responsible for policies issued by PT Asuransi Allianz Life Indonesia. Investment fund management based on the choice of the MyProtection Bijak II sub-fund is carried out by PT Asuransi Allianz Life Indonesia and/or the Investment Manager appointed by PT Asuransi Allianz Life Indonesia and is the responsibility of PT Asuransi Allianz Life Indonesia. The performance of the choice of sub-funds from PT Asuransi Allianz Life Indonesia can be seen in the monthly Fund Fact Sheet report.

- PT Bank Maybank Indonesia, Tbk is licensed and supervised by OJK & Bank Indonesia.

- Investments in capital market instruments contain market risk. The performance of the Sub Fund is not guaranteed, unit prices and income from the Sub Fund may increase or decrease. The past performance of Sub Fund options is not an indication of future performance. Full details are in the Fund Fact Sheet.

- You can learn more about the terms and conditions, including detailed fees and exclusions, in the General Product and Service Information Summary (RIPLAY) and Personal Product and Service Information Summary (RIPLAY) and Policy.

PAYDI

Produk Asuransi Yang Dikaitkan dengan Investasi (PAYDI) MyProtection Bijak II is an insurance product. The investment component in PAYDI contains risks. Prospective Policyholders must read and understand the General and RIPLAY Personal Product and Service Information Summary (RIPLAY) before deciding to buy PAYDI. PAYDI's past investment performance does not reflect PAYDI's future investment performance.