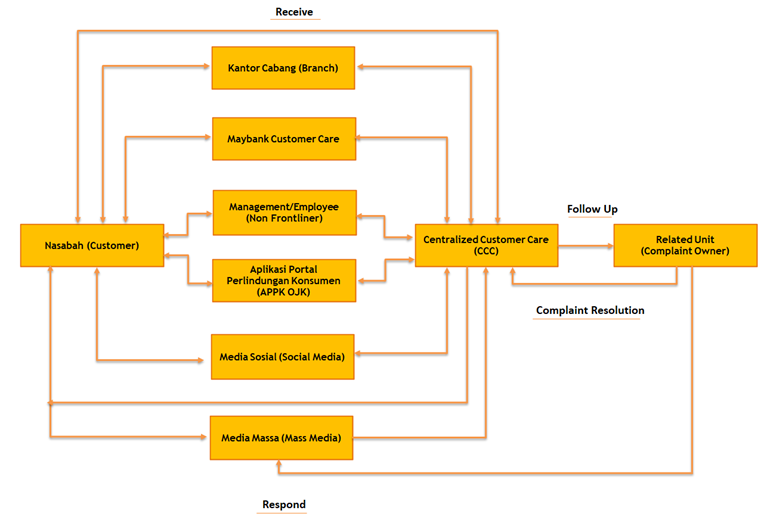

Customer Complaint Submission and Follow-Up Mechanisms

In accordance with the rules and regulations of Indonesia Financial Conduct Authority (Otoritas Jasa Keuangan (OJK)), PT Bank Maybank Indonesia Tbk is required to inform the Customer Complaint Mechanism as the Bank's commitment to guarantee the Customer's right to submit complaints related with Bank products and services.

Customer can submit written complaints via letter, email, fax, or social media, verbally via Maybank Customer Care or visit Maybank Branch Office, by completing the complaint with proof of identity and supporting documents.

Customer Complaint Management Flow

Documents that Need to be Attached for Complaints in General

- Customer and/or Customer Representative Identity or ID.

- Power of Attorney Letter from the Customer to the Customer's Representative stating that the Customer grants authority to the other counterpart i.e. Individual, Institution, Legal Counsel and/or Legal Entity in representing Customer to act for and on behalf of the Customer in the case of Complaints with sufficiently stamped.

- Specific type and date of financial transaction that being reported.

- Chronology of the Complaint itself.

- Other supporting documents.

Other supporting documents related to the transaction that being reported (examples: deposit slip, transaction receipt, insurance policy, credit agreement, and/or certificate of domicile) will be required for following through Customer Complaints and/or in accordance with the Bank's internal Policies and Procedures.

Steps for Complaint Submission

Customer/Customer’s Representative submit Complaints through

- Contact Maybank Customer Care at 1500611 or +622178869811 (from overseas)

- Email to customercare@maybank.co.id

- All Maybank Branch Offices CLICK HERE

- Visit www.maybank.co.id on menu "Contact Us"

- Maybank Social Media @maybankid (Instagram, X)

- Especially for Customer’s Representative, complaints can be submitted only through the nearest Maybank Branch Office with the attorney from the Customer

The flow of the Bank when Receiving Customer Complaint

- Bank receives customer’s complaint.

- Bank’s officer tends to customer’s complaint.

- If the Bank’s officer is unable to provide the solution on that same day, then the complaint will be followed up by Relevant Units to find the proper solution.

- Upon register Customer complaint, the Bank Staff will provide Customer with a Complaint Receipt Number and information of maximum complaint resolution is 10 working days. Should there’s any additional supporting document is required, Customer will be notified promptly in order to following through the complaint.

- In certain cases, the Bank may need to extend the complaint resolution timeframe by adding another 10 working days. Should this occurs, Customer will be notified through the Customer registered contact detail."

- The results of the follow-up and complaint resolution will be conveyed to the Customer via the media/communication channels provided by PT Bank Maybank Indonesia Tbk.

- If the Customer does not agree with the resolution/follow-up provided by the Bank, the Customer can submit their objection to the results of the resolution in written form to PT Bank Maybank Indonesia Tbk.

In accordance with regulation of Indonesia Financial Conduct Authority (Otoritas Jasa Keuangan (OJK)), Customer who is dissatisfied with the resolution of their complaint with the Bank can also convey this to OJK via:

- Written letter to

Anggota Dewan Komisioner Otoritas Jasa Keuangan

Bidang Edukasi dan Perlindungan Konsumen

Menara Radius Prawiro, Lantai 2

Komplek Perkantoran Bank Indonesia

Jl. MH. Thamrin No. 2

Jakarta Pusat 10350 - Phone and WhatsApp

Call: 157

Operational Hours: Monday – Friday, 08.00 – 17.00 WIB (except Holidays)

WhatsApp: 081-157-157-157 - Email

Request for information and complaint can be submitted via email with address: konsumen@ojk.go.id - Online Complaint Form

Customer or Public can convey their complaints through electronic form available at the address:

https://kontak157.ojk.go.id/appkpublicportal/Pengaduan

Submission of Complaint via official Letter to OJK accompanied by:

- Proof of Submission of the Complaint to the Bank and/or the solution from the Bank;

- Personal identity or power of attorney (for those represented);

- Description/chronology of complaints;

- Supporting documents.

If the requested data/documents are not fulfilled by the Customer within no later than 20 working days from the date of notification, then the complaint is considered cancelled/resolved.

Customer and Public can also submit requests for information or complaints in relation to payment system activities, money services, money markets and foreign exchange markets to Bank Indonesia (BI) via:

- Contact Center Bank Indonesia Call and Interaction (BICARA) phone 131 atau 1500131

- E-mail to bicara@bi.go.id

- Written Letter to Bank Indonesia Representative Office (KPw BI) closest to the Customer’s domicile.

For Customer in Jakarta, Bogor, Depok and Bekasi:

Kantor Perwakilan Bank Indonesia DKI Jakarta

Divisi Perlindungan Konsumen Sistem Pembayaran

KPw DKI Learning Center

Jl. Prajurit KKO Usman dan Harun No.42

RT/RW: 01/05 Senen

Jakarta Pusat 10410 - Website: https://bicara131.bi.go.id/

If there is a dispute between the Customer and the Bank, then the Customer can submit a dispute resolution by mediation to the Institution of Alternative Dispute Resolution Financial Services Sector (LAPS-SJK)

Definition of Complaint Resolution Indicating Disputes

- Dispute is a disagreement between the Customer and the Bank which has gone through a complaint resolution process by the Bank and is caused by material, reasonable and direct losses and/or potential losses to the Customer because the Bank does not fulfill the agreement and/or documentation of the agreed financial transactions.

- Complaint Indicating Disputes is the expression of Customer’s dissatisfaction caused by material, reasonable and direct losses and/or potential losses to the Customer because Bank does not fulfill the agreement and/or documentation of the agreed financial transactions.

- Facilitation is a Dispute resolution effort initiated by the OJK by bringing together the Customer and the Bank to review the problem fundamentally in order to obtain an agreement to resolve the Dispute, the results of which are stated in a Deed of Agreement or Minutes of Facilitation.

- Limited Facilitation is an effort to resolve disputes by bringing together the Customer and the Bank to review the problem fundamentally in order to obtain an agreement to resolve the dispute without a Deed of Agreement or Minutes of Facilitation.

- Deed of Agreement is a written document containing the agreement resulting from the Facilitation in which it is final and binding the Customer and the Bank

- Complaint Response is the explanation of the problem or a final resolution offer from the Bank to the Customer verbally or in written form

- Requirements for Complaint Resolution Indicating Disputes are as follow referring to POJK No. 31/POJK.07/2020 concerning the Implementation of Customer and Community Services in the Financial Services Sector by Otoritas Jasa Keuangan:

- Submission for Customer dispute resolution can only be made by the Customer or Customer’s Representative.

- The dispute submitted is a civil dispute.

- Customer experience losses and/or potential losses with a maximum of IDR500,000,000,- (five hundred million rupiah).

- Complaint Indicating Disputes has been attempted to be resolved by the Bank but has not reached the agreement by the Customer.

- The submitted Complaint Indicating Disputes is not a Dispute that is currently in process or has been decided by a judicial institution, arbitration or alternative dispute resolution institution. Including that it has never been facilitated by the OJK.

- Resolution submission of a Complaint Indicating Disputes shall be made no later than 60 (sixty) working days, from the date of the Complaint Response. In the event that the Customer submits an objection to the Complaint Response, the submission for Complaint resolution shall not exceed 20 (twenty) working days from the date of the response to the objection.

- Submission of a request for resolution of a Complaint Indicating Disputes is made in written form in the format following to the terms & conditions, by including documents in the form of:

- Customer Identity;

- Complaint response given by the Bank to the Customer or if the Customer has not received a Complaint Response:

- Proof of receipt of Complaint Indicating Dispute signed or issued by the Bank

- Proof of submitting a Complaint Indicating a Dispute to the Bank

- Confirmation of receipt of Complaints Indicating Dispute verbally from the Bank

- Statement letter on sufficient stamp duty that the Dispute being submitted is not currently in process or has ever been decided by a judicial institution, arbitration or alternative dispute resolution institution and has never been facilitated by the OJK;

- Other supporting documents related to the Complaint Indicating Dispute.

Short Terms and Conditions For Dispute Resolution Through LAPS-SJK

POJK Reference No. 61/POJK.07/2020 concerning Alternative Dispute Resolution Institutions in the Financial Services Sector

- Complaints have been attempted to be resolved by the Bank but no agreement has been reached by the Customer or the Customer has not received a response to the complaint as regulated in the Otoritas Jasa Keuangan Regulations regarding Customer complaint services in the Financial Services Sector.

- The dispute submitted is not a dispute that is currently in process or has been decided by a judicial institution, arbitration or other alternative dispute resolution institution.

- Dispute handling through LAPS-SJK is confidential.

- The dispute submitted is a civil dispute.

- Dispute resolution through LAPS-SJK can be done by:

- Face-to-face meeting with the mediator or arbitrator;

- Electronic media; and/or

- Document inspection

LAPS-SJK can be contacted through:

- Written Letter to:

Lembaga Alternatif Penyelesaian Sengketa Sektor Jasa Keuangan (LAPS-SJK)

Wisma Mulia 2 Lt.16

Gatot Subroto No.42

Jakarta Selatan 12710 - Telephone: 021-29600292

- Email: info@lapssjk.id

- Kontak LAPS-SJK: https://lapssjk.id/kontak/

- Web LAPS-SJK: https://lapssjk.id/