HELLO M2U

July - September 2025 Edition

What's New on M2U?

Maybank KTA via M2U ID App available This August!

Need extra funds for education, home renovation, business capital, or to fulfill a long-awaited dream?

Maybank KTA is here as a quick, collateral-free loan solution that you can now apply for anytime, anywhere, directly through M2U ID App, with no need to visit a branch.

Why apply for Maybank KTA via M2U ID App?

Maybank understands the importance of convenience and speed when it comes to loan applications. That’s why we’re offering Maybank KTA via M2U ID App, complete with these key benefits:

- No Collateral Required

No need to pledge any assets. The process is purely based on your financial capability and credit history. - 100% Online Process

All steps are done through M2U ID App, no physical documents, no queues. - Installment Simulation Before Applying

Estimate your monthly installments based on the loan amount and tenure you choose, before submitting your application. - High Loan Limit & Flexible Tenor

Get access to large loan amounts customized to your needs. Borrow up to IDR 250 million for Payroll Customers and up to IDR150 million for Non-Payroll Customers, with flexible repayment periods based on your financial capacity. - Real-Time Status Tracking

Monitor your application progress directly through M2U ID App. - Instant Disbursement to Your Account

Once approved, the funds are transferred straight into your account and can be used immediately for various transactions within M2U ID App.

Applying for a Maybank KTA via M2U ID App means more than just getting financial support, it’s about enjoying a seamless, modern experience that’s fast, efficient, and time-saving.

Apply Maybank KTA and turn your plans into reality!

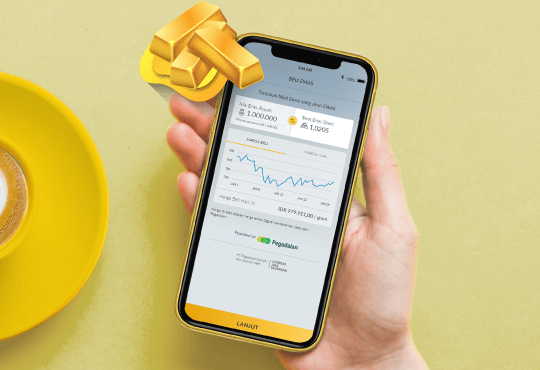

Bond Simulation & Learning Features

SBN (Government Bonds) features in M2U ID App just got better!

Manage and monitor both Primary and Secondary Market Government Bonds (SBN) more easily from your M2U ID App.

Now enhanced with:

- SBN coupon/return simulator.

- Learn more about SBN.

- Sell SBNs that are not being used as collateral.

- Set or change your registered account for SBN transactions.

Investing in SBN has never been more practical, right at your fingertips.

Check out the new features now on the M2U ID App!

Investment Information Feature

Now you can access all your investment information in one place.

The new menu includes:

- Market insights and mutual fund performance.

- Monitor your Primary Market SBN order status.

- Learn more about SBN.

- Check your risk profile and E-SBN investor profile.

- Set or change your registered account for SBN transactions.

Find this new feature at the bottom of the “Investment & Insurance” section on the M2U ID App.

Manage and monitor your investments more easily, everything in the palm of your hand.