SBN for beginners: safe and affordable investments starting from Rp1 million

29 July 2025

Government Securities (SBN) can be the right choice. This product offers security, transparency and ease of access, making it suitable for those who are just starting to build investment habits.

Understanding Government Securities (SBN)

SBN is a debt instrument issued by the Government of the Republic of Indonesia. When someone purchases SBN, it means they are lending funds to the state, which will be used to finance the state budget for various national development programmes. In return, investors will receive periodic returns and principal repayment at maturity.

Who issues SBN?

SBN is issued by the Ministry of Finance of the Republic of Indonesia, specifically by the Directorate General of Financing and Risk Management (DJPPR). The coupons and principal of SBN investments are guaranteed by the state in accordance with Law No. 24 of 2002. Since they are directly guaranteed by the state, SBNs have a very low risk level and are considered the safest investment instrument in the market. Not only that, SBNs are an attractive investment option because they offer competitive coupons or returns with lower tax rates compared to bank deposits.

How does SBN work?

SBN works very simply. Investors purchase SBN through distribution partners appointed by the government, such as Maybank. After that, investors will receive regular coupon payments, usually every month. At the end of the term (tenor), the principal amount will be returned in full. For certain types of SBN, investors also have the option to redeem the funds early during the early redemption period or sell them on the secondary market after the Holding Period (MHP) has passed.

Why are beginners advised to start with Primary Market SBN?

.jpeg)

Investments Starting from IDR 1 Million

One of the advantages of Retail SBN is its accessibility. Unlike other instruments that often require large amounts of capital, you can purchase SBN with a minimum nominal value of IDR 1 million. This amount is affordable for various groups, from young workers to housewives who want to start saving and investing regularly.

Benefits of Investing in Retail SBN

Here are some of the benefits of investing in Retail SBN, especially for early-stage investors:

- Safe and guaranteed by the state through legislation.

- Fixed and stable returns, providing certainty of cash flow every month.

- Small initial capital, only IDR 1 million to start.

- Suitable for medium-term planning such as education costs or emergency funds.

- Sharia-compliant products are available, such as Sukuk Tabungan (ST) and Sukuk Ritel (SR).

- Lower tax rate on coupons (10%) compared to deposit tax (20%).

Investment Risks of SBN

Like other investment instruments, SBN also carries risks, but these risks are very low as they are directly guaranteed by the government and relatively easy to manage.

Here are some risks to be aware of:

-

Liquidity risk/h3>

For non-tradable products (SBR and ST), investors cannot withdraw funds at any time. Withdrawals can only be made through the early redemption feature and only during certain periods. In addition, tradable products (ORI & SR) carry the risk that you will not be able to sell SBN quickly at a reasonable price.

-

Market risk

For tradable products (ORI and SR), if you wish to sell in the secondary market before maturity, the price may fluctuate depending on market conditions. If sold below the purchase price, losses may occur. Factors influencing the overall performance of the market include changes in interest rates, changes in economic fundamentals, and unstable political conditions.

-

Inflation risk

Fixed returns may be negatively impacted in real terms if inflation rises significantly. However, SBNs with floating coupons (SBR and ST) provide protection by adjusting returns in line with benchmark interest rates.

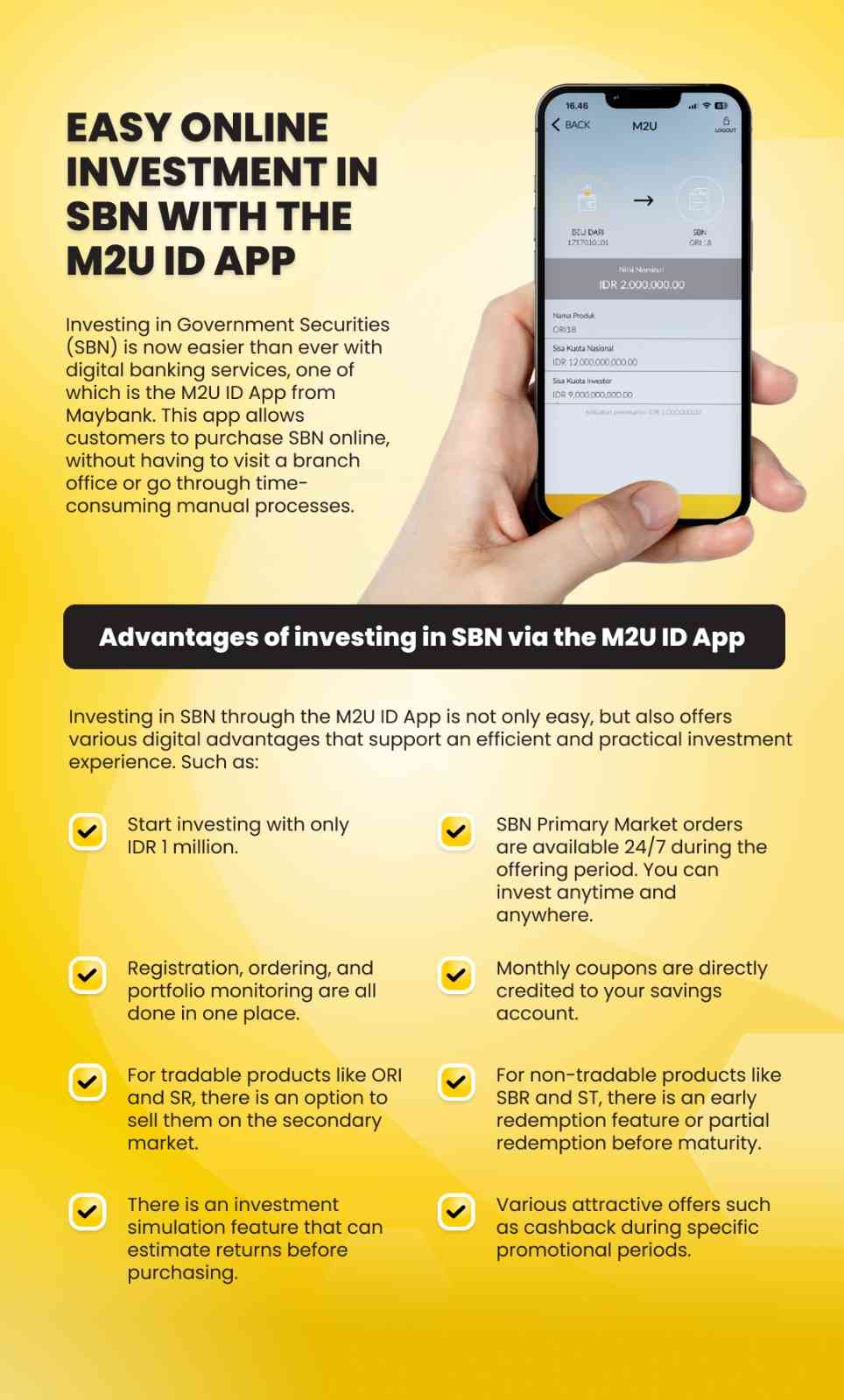

Easy online investment in SBN with the M2U ID App

Investing in Government Securities (SBN) is now easier than ever with digital banking services, one of which is the M2U ID App from Maybank. This app allows customers to purchase SBN online, without having to visit a branch office or go through time-consuming manual processes.

Build your financial future starting now. Investments don't have to be large, the important thing is to be consistent and understand them. Start your investment journey with SBN, only through the M2U ID App.