MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah

MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah is a Sharia-based traditional individual life insurance product with Regular Contributions that provides benefits for Death, Death Due to Accident, Contribution Exemption Benefit, and Tahapan RENCANA Benefit.

Advantages of MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah

Notes:

(1) Total Contributions paid by the Participant or Contributor (whichever is applicable) and received by Allianz.

(2) Policy Year since the Policy Effective Date.

(3) As stated in the Policy Data or endorsements, if any.

(4) The Accidental Death Benefit will only be paid to the Beneficiary if the Insured passes away within 90 calendar days from the date of the Accident.

(5) Allianz will provide the Contribution Exemption Benefit subject to the terms and conditions in the Policy Specific Conditions.

(6) Policy application for Insured individuals specifically for adults & income earners with Guaranteed Issue Offer (GIO) underwriting type. For Policy applications with Insurance Sums exceeding IDR1,500,000,000, Full Underwriting will be applied.

(7) The maximum value of the Insurance Sum and/or Savings Balance that can be endowed if the Insured passes away, and claims for the Death Benefit, or Accidental Death Benefit and/or Tahapan RENCANA Benefit (whichever is applicable) are approved by Allianz as stated in the Waqf Application Form and Waqf Promise (wa’ad) or other terms and conditions informed by Allianz and/or the chosen waqf institution.

Benefit of MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah

- Death Benefit

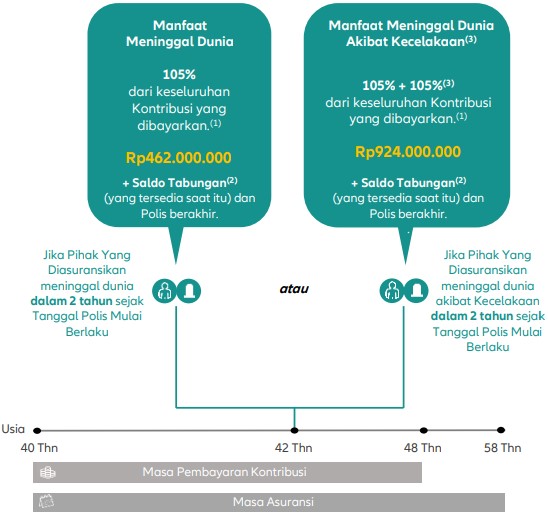

By still following the General Policy Terms, if during the Insurance Period the Insured passes away, PT. Asuransi Allianz Life Syariah Indonesia will pay the Death Benefit to the Beneficiary under the following conditions :- If the Insured passes away within 2 (two) years from the Policy Effective Date, then the Death Benefit that PT. Asuransi Allianz Life Syariah Indonesia will pay to the Beneficiary is 105% (one hundred and five percent) of the total Contributions paid by You or the Contributor (whichever is applicable) and received by PT. Asuransi Allianz Life Syariah Indonesia, plus the Savings Balance (available at that time), and the Policy terminates; or

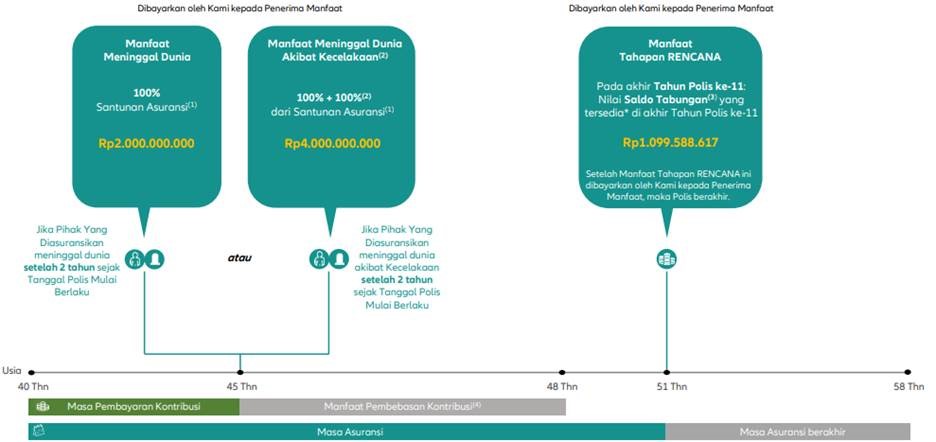

- If the Insured passes away after 2 (two) years from the Policy Effective Date, then the Death Benefit that will be paid by PT. Asuransi Allianz Life Syariah Indonesia to the Beneficiary is 100% (one hundred percent) of the Insurance Sum for the Basic Insurance, as stated in the Policy Data or Endorsement, if any. In this case, (i) the Policy related to the Basic Insurance will remain in force until the End Insurance Date, unless terminated earlier according to the Policy terms and conditions; and (ii) Additional Insurance (if any) will terminate if the Terms and Conditions of the Additional Insurance stipulate that the Additional Insurance terminates upon the Insured's death.

- Accidental Death Benefit

- By still following the General Policy Terms, When during the insurance period the Insured Party passes away due to an accident, PT. Asuransi Allianz Life Syariah Indonesia will pay the Death Benefit due to the accident. You will pay the Death Benefit due to the accident to the Beneficiary under the following conditions:

- If the Insured Party passes away due to an Accident within 2 (two) years from the Effective Date of the Policy, PT. Asuransi Allianz Life Syariah Indonesia will pay the Death Benefit due to the Accident amounting to 105% (one hundred five percent) of the total Contributions paid by You or the Contributor (whichever is applicable) and received by PT. Asuransi Allianz Life Syariah Indonesia, and the Policy will terminate; or

- If the Insured Party passes away due to an accident after 2 (two) years from the Effective Policy Date, PT. Asuransi Allianz Life Syariah Indonesia will pay the Death Benefit due to the accident amounting to 100% (one hundred percent) of the Insurance Benefit for the Basic Insurance, as stated in the Policy Data or Endorsement, if any. In this case, (i) the Policy related to the Basic Insurance will remain in force until the Insurance End Date, unless terminated earlier in accordance with the terms and conditions of the Policy; and

- Additional insurance (if any) will terminate if the terms and conditions of the additional insurance stipulate that the additional insurance terminates when the Insured Party passes away

- The Death Benefit due to Accident to be paid by PT. Asuransi Allianz Life Syariah Indonesia under this Policy is up to the maximum amount of IDR5,000,000,000 (five billion Indonesian Rupiah).

- This Death Benefit due to Accident will be paid as an addition to the Death Benefit.

- This Death Benefit due to Accident will only be paid to the Beneficiary if the Insured Party passes away within 90 (ninety) calendar days from the date of the Accident occurrence. This benefit will only be paid if the Insured passes away within 90 (ninety) days from the date of the Accident.

- By still following the General Policy Terms, When during the insurance period the Insured Party passes away due to an accident, PT. Asuransi Allianz Life Syariah Indonesia will pay the Death Benefit due to the accident. You will pay the Death Benefit due to the accident to the Beneficiary under the following conditions:

- Contribution Exemption Benefit

If the Insured Party passes away after 2 (two) years from the Effective Policy Date, and the claim for this Contribution Exemption Benefit has been approved by PT. Asuransi Allianz Life Syariah Indonesia, PT. Asuransi Allianz Life Syariah Indonesia will provide the Contribution Exemption Benefit under the following terms and conditions:

- You or the Contributor (whichever is applicable) will be exempted from the obligation to pay the Basic Insurance Contribution, effective from the next Contribution Due Date (after the date of claim approval by PT. Asuransi Allianz Life Syariah Indonesia) until the end of the Contribution Payment Period; and

- Effective from the next Contribution Due Date (after the date of claim approval by Us) until the end of the Contribution Payment Period, PT. Asuransi Allianz Life Syariah Indonesia will allocate funds (taken from the Tabarru' Fund) into the Savings Balance (as determined in the Policy) on each Contribution Due Date.

- Benefits of the Plan Stages

- The Death Benefit due to Accident to be paid by PT. Asuransi Allianz Life Syariah Indonesia under this Policy is up to the maximum amount of IDR5,000,000,000 (five billion Indonesian Rupiah).

- If the Insured Party is still alive on the End Date of Insurance and the Policy is still valid (inforce), then:

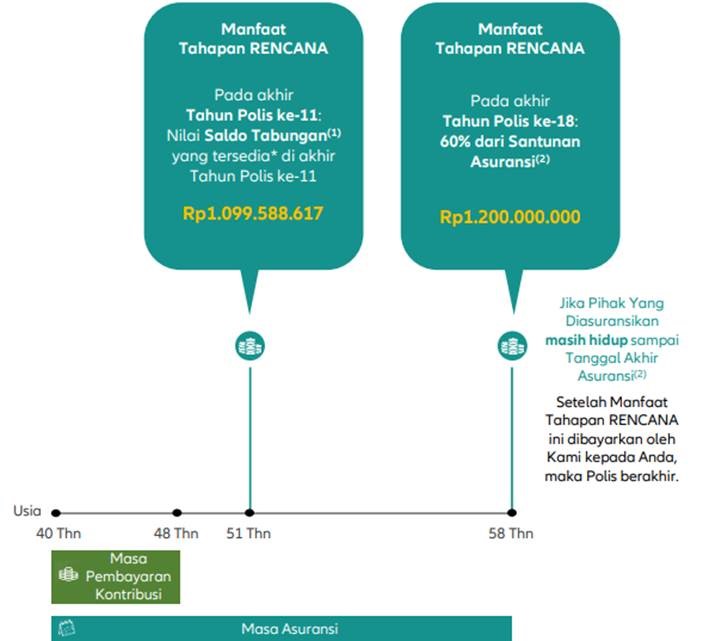

- At the end of the 11th Policy Year, we will provide the Tahapan RENCANA Benefit to you in the amount of the available Savings Balance* at the end of that 11th Year; and

- At the end of the 18th Policy Year, we will provide the PLAN Stage Benefit to you amounting to 60% (sixty percent) of the Insurance Benefit for the Basic Insurance, as stated in the Policy Data or Endorsement, if any. After the payment of this Tahapan RENCANA Benefit is made by us to you, the Policy will terminate.

Every Insurance Benefit will be paid by PT. Asuransi Allianz Life Syariah Indonesia after deducting any other obligations (if any).

(The available Savings Balance at the end of the 11th Policy Year is projected to be 50% (fifty percent) of the Insurance Benefit. However, PT. Asuransi Allianz Life Syariah Indonesia does not guarantee the accuracy of this projected value, so the amount of the Tahapan RENCANA Benefit paid in the 11th Policy Year will remain the actual available Savings Balance at that time.

Terms and Conditions of MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah

| Insured Entry Age | 1 month old – 55 years old (nearest birthday). | ||||||||||||||||||||

| Participant Entry Age | 18 years old – there is no maximum age (nearest birthday). | ||||||||||||||||||||

| Mata Uang | Rupiah | ||||||||||||||||||||

| Masa Pembayaran Kontribusi | 18 tahun | ||||||||||||||||||||

| How to Pay Contributions |

The Contribution payment scheme is a periodic Contribution (monthly, quarterly, semi-annually and annually).

|

||||||||||||||||||||

| Contributions Alocations |

Acquisition and Maintenance Ujrah is an ujrah in connection with insurance applications and policy issuance which includes, among other things, the costs of procuring the policy and printing documents for field ujrah, postal ujrah and telecommunications for employees and agents. |

||||||||||||||||||||

| Minimum Insurance Compensation |

Maximum Insurance Benefit for Children (up to 17 years old): IDR3,000,000,000 |

||||||||||||||||||||

| Underwriting |

Insured Party: Adult and income earner:

Insured Party: Child (up to 17 years old) or non-income earner:

|

||||||||||||||||||||

| Contribution Leave | Not Available. |

Simulation (Product Illustrations)

|

Insured Name : Dani

Accidental Death Benefit

Tahapan RENCANA Benefit

|

Needs: Protection for future financial plans. |

Illustration of Insurance Benefits, including Tahapan RENCANA Benefit from the Contributions paid (in Indonesian Rupiah)

| Policy Year | Annual contributions | Accumulated Contributions | Insurance Benefit | Savings Balance | Tahapan RENCANA Benefit | |

| Death Benefit | Accidental Death Benefit | |||||

| 1 | 220.000.000 | 220.000.000 | 231.000.000 | 231.000.000 | 93.280.000 | - |

| 2 | 220.000.000 | 440.000.000 | 462.000.000 | 462.000.000 | 192.156.800 | - |

| 3 | 220.000.000 | 660.000.000 | 2.000.000.000 | 2.000.000.000 | 296.966.208 | - |

| 4 | 220.000.000 | 880.000.000 | 2.000.000.000 | 2.000.000.000 | 408.064.180 | - |

| 5 | 220.000.000 | 1.100.000.000 | 2.000.000.000 | 2.000.000.000 | 525.828.031 | - |

| 6 | 220.000.000 | 1.320.000.000 | 2.000.000.000 | 2.000.000.000 | 650.657.713 | - |

| 7 | 220.000.000 | 1.540.000.000 | 2.000.000.000 | 2.000.000.000 | 782.977.176 | - |

| 8 | 220.000.000 | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | 923.235.807 | - |

| 9 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | 978.629.955 | - |

| 10 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | 1.037.347.752 | - |

| 11 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | 1.099.588.617 | 1.099.588.617 |

| 12 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 13 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 14 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 15 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 16 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 17 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | - |

| 18 | - | 1.760.000.000 | 2.000.000.000 | 2.000.000.000 | - | 1.200.000.000 |

Simulation (Product Illustration) above is only an overview

Notes :

- The Savings Balance value in the table above is based on the assumption of a 6% (six percent) annual investment return. However, these assumptions and values are NOT GUARANTEED. The amount available will depend on investment returns.

- In the event of Policy redemption, the illustrated Savings Balance above does not yet include the Policy Redemption Ujrah.

- Tahapan RENCANA Benefit is provided gradually as follows:

- At the end of the 11th Policy Year: The available value of Savings Balance*, if the Insured Party is still alive or passes away after 2 (two) years from the Effective Policy Date.

- At the end of the 18th Policy Year: 60% (sixty percent) of the Insurance Benefit, if the Insured Party is still alive until the 18th Policy Year.

Every Insurance Benefit will be paid by PT Asuransi Allianz Life Syariah Indonesia after deducting any other obligations (if any).

Assuming an investment performance of 6% (six percent) per year from the Savings Balance, the projected available Savings Balance at the end of the 11th Policy Year is estimated to be 50% (fifty percent) of the Insurance Compensation. However, we do not guarantee the accuracy of this projection, so the amount of the PLAN Stage Benefit paid in the 11th Policy Year will remain the actual available Savings Balance at that time.

Illustration of the Benefit of MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah

|

Dani (Participant & Insured Party): Contribution Payment Period: |

Insurance needs: Protection for future financial plans. |

|

Paid by PT. Asuransi Allianz Life Syariah Indonesia to Benefit Recipients |

|

- The total Contributions paid by You or the Contributor (whichever is applicable) and received by PT. Asuransi Allianz Life Syariah Indonesia.

- The total of the allocated and invested Contributions by PT. Asuransi Allianz Life Syariah Indonesia, including its investment returns. Information regarding the percentage allocation of Contributions invested by Us is stated in the Policy Data (as may be amended from time to time according to the Policy provisions).

- The Accidental Death Benefit will only be paid to the Beneficiary if the Insured Party passes away within 90 (ninety) calendar days from the date of the Accident occurrence.

Every Insurance Benefit will be paid by us after deducting any other obligations (if any).

|

Dani (Participant & Insured Party): |

Insurance needs: Protection for future financial plans. |

|

|

|

- As stated in the Policy Data or endorsements, if any.

- The Accidental Death Benefit will only be paid to the Beneficiary if the Insured Party passes away within 90 (ninety) calendar days from the date of the Accident occurrence.

- The total of the allocated and invested Contributions by PT Asuransi Allianz Life Syariah Indonesia, including its investment returns. Information regarding the percentage allocation of Contributions invested by PT Asuransi Allianz Life Syariah Indonesia is stated in the Policy Data (as may be amended from time to time according to the Policy provisions).

- If We have approved the claim for the Contribution Exemption Benefit, We will provide the Contribution Exemption Benefit subject to the terms and conditions specified in the Policy Special Provisions.

Every Insurance Benefit will be paid by PT Asuransi Allianz Life Syariah Indonesia after deducting any other obligations (if any).

*Assuming an investment performance of 6% (six percent) per year from the Savings Balance, the projected available Savings Balance at the end of the 11th Policy Year is estimated to be 50% (fifty percent) of the Insurance Benefit. However, We do not guarantee the accuracy of this projection, so the amount of the PLAN Stage Benefit paid in the 11th Policy Year will remain the actual available Savings Balance at that time.

|

Dani (Participant & Insured Party): |

Insurance needs: Protection for future financial plans. |

|

|

|

- The total of the allocated and invested Contributions by PT Asuransi Allianz Life Syariah Indonesia, including its investment returns. Information regarding the percentage allocation of Contributions invested by PT Asuransi Allianz Life Syariah Indonesia is stated in the Policy Data (as may be amended from time to time according to the Policy provisions).

- As stated in the Policy Data or endorsements, if any.

- Subject to the Policy remaining in force (inforce). The end date of the Basic Insurance based on the MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah Policy, as stated in the Policy Data and/or Endorsements (if any).

Every Insurance Benefit will be paid by PT Asuransi Allianz Life Syariah Indonesia after deducting any other obligations (if any).

Assuming an investment performance of 6% (six percent) per year from the Savings Balance, the projected available Savings Balance at the end of the 11th Policy Year is estimated to be 50% (fifty percent) of the Insurance Benefit. However, PT Asuransi Allianz Life Syariah Indonesia do not guarantee the accuracy of this projection, so the amount of the Tahapan RENCANA Benefit that paid in the 11th Policy Year will remain the actual available Savings Balance at that time.

About Allianz

About Allianz Group

Allianz Group is a leading insurance and asset management company in the world with over 122 million individual and corporate customers in more than 70 countries. Allianz customers benefit from a wide range of individual and group insurance services, ranging from property, life, and health insurance to global credit insurance and business insurance assistance services. Allianz is one of the largest investors in the world, with customer insurance assets under management exceeding 714 billion Euros. Meanwhile, our asset managers, PIMCO and Allianz Global Investors, manage an additional 1.7 trillion Euros of third-party assets. Thanks to systematic integration of ecological and social criteria into business processes and investment decisions, Allianz holds a leading position among insurance companies in the Dow Jones Sustainable Index. In 2022, the Allianz Group had 159,000 employees and achieved total revenues of 152.7 billion Euros, with an operating profit of 14.2 billion Euros.

About Allianz in Asia

Asia is one of the core growth regions for Allianz, characterized by cultural diversity, languages, and customs. Allianz has been present in Asia since 1910, providing fire and maritime insurance in coastal cities of China. Currently, Allianz is active in 15 markets in the region, offering a wide range of insurance products with core businesses in property insurance, life insurance, protection and health solutions, and asset management. With over 36,000 employees, Allianz serves the needs of more than 21 million customers in this region through various distribution channels and digital platforms.

About Allianz Indonesia

Allianz began its business in Indonesia by opening a representative office in 1981. In 1989, Allianz established PT Asuransi Allianz Utama Indonesia, a general insurance company. Subsequently, Allianz entered the life, health, and pension insurance business by founding PT Asuransi Allianz Life Indonesia in 1996. In 2006, Allianz Utama and Allianz Life ventured into the Shariah insurance business. In 2023, PT Asuransi Allianz Life Syariah Indonesia officially commenced operations as a separate entity providing Shariah-based insurance protection and financial risk management. Today, Allianz Indonesia is supported by over 1,000 employees and more than 40,000 marketers, backed by a network of banking partners and other distribution partners. Currently, Allianz is one of the leading insurance companies in Indonesia, trusted to protect over 10 million policyholders.

PT Asuransi Allianz Life Indonesia is licensed and supervised by Otoritas Jasa Keuangan, and its Marketers hold a license from the Indonesian Life Insurance Association

Important Notes:

- PT Bank Maybank Indonesia, Tbk is licensed and supervised by OJK & Bank Indonesia.

- PT Asuransi Allianz Life Syariah Indonesia is a licensed bank under the supervision of Otoritas Jasa Keuangan and Its marketers have been licensed by Asosiasi Asuransi Syariah Indonesia.

- The contributions paid already include commissions for the Bank.

- A comprehensive explanation of insurance protection is available in the Policy. Insurance protection is subject to exclusions stated in the Policy, which are matters not covered in the Policy.

- PT. Asuransi Allianz Life Syariah Indonesia will inform you of any changes to benefits, Ujrah, risks, terms, and conditions as stated in the Policy no later than 30 (thirty) working days before the effective date of such changes.

- MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah is an insurance product issued by PT Asuransi Allianz Life Syariah Indonesia. The Bank only acts as a reference giver for MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah. MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah is not a Bank product, so the Bank is not responsible for any and all claims and any risks whatsoever related to Policies issued by PT Asuransi Allianz Life Syariah Indonesia. MyProtection RENCANA (sejahteRa dENgan renCANa keuangan mAtang) Syariah is not protected by the Bank and its affiliates and is not covered under the scope of the Indonesian Government's protection program or the Deposit Insurance Corporation ("LPS"). The use of the Bank's name, logo, and other attributes in the General Product and Service Information Summary (RIPLAY) does not imply that the insurance product is a Bank product.

- PT. Asuransi Allianz Life Syariah Indonesia reserves the right to reject your Policy application if it does not meet the applicable requirements and regulations.