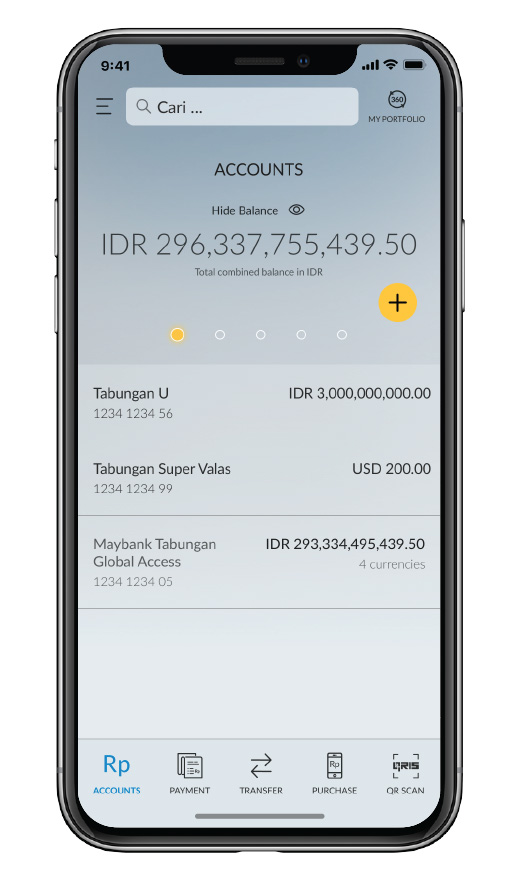

Buying, selling, or transferring foreign currency can now be done anytime, anywhere—easily and conveniently—right at your fingertips via the M2U ID App (mobile banking) and M2U ID Web (internet banking). Available in various currencies: USD, SGD, EUR, AUD, JPY, HKD, GBP, CHF, and CNY.

CNY transactions are only available through the M2U ID App.

Enjoy competitive exchange rates and a range of other benefits, including:

- No conversion fees for all foreign exchange transactions

- Real-time exchange rate information

- Foreign currency transfers to other banks can be made from 02:00 AM to 02:00 PM (Western Indonesia Time), excluding Sundays/public holidays. These transactions are subject to SWIFT (Society for Worldwide Interbank Financial Telecommunication) or correspondent bank fees.

Fee info: www.maybank.co.id/limitbiaya - Foreign currency buy/sell and transfers to Maybank accounts can be made 24/7, including on public holidays.

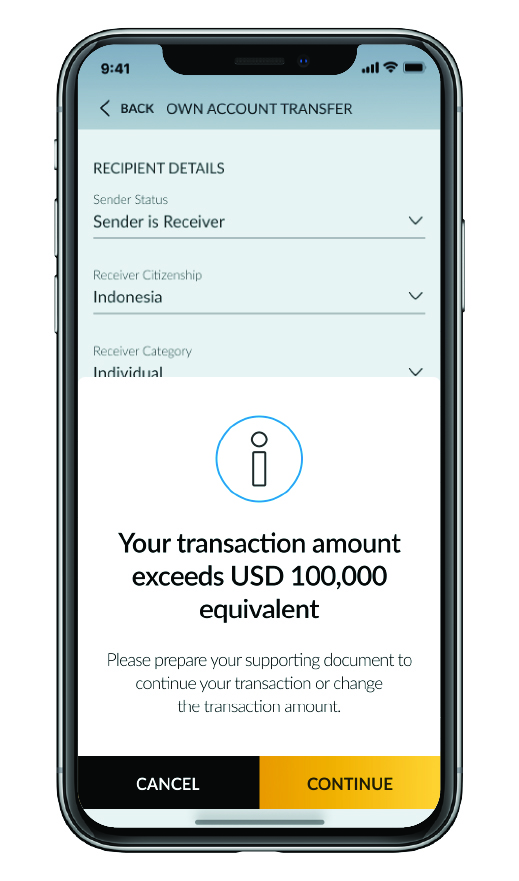

For SWIFT transactions exceeding the equivalent of USD100,000 per month, Bank Indonesia (BI) regulations apply. Customers may be required to upload supporting documents via the M2U ID App.

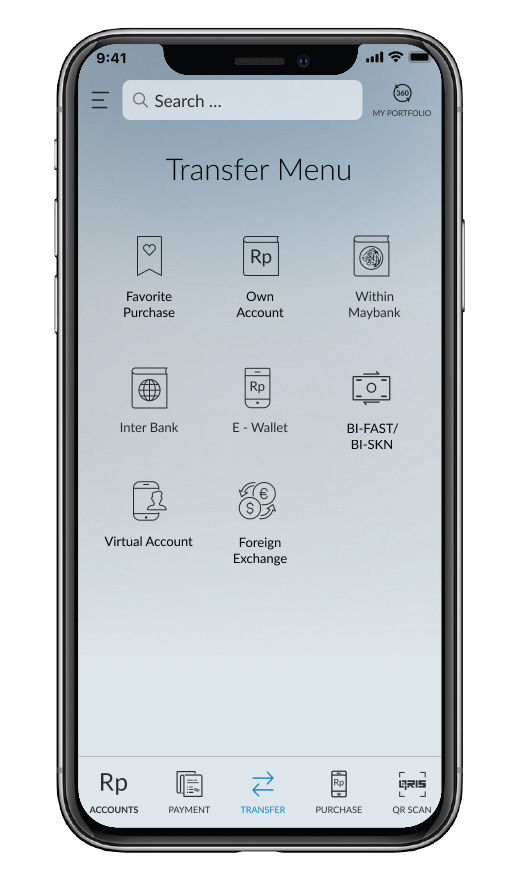

TRANSACTION GUIDE

|

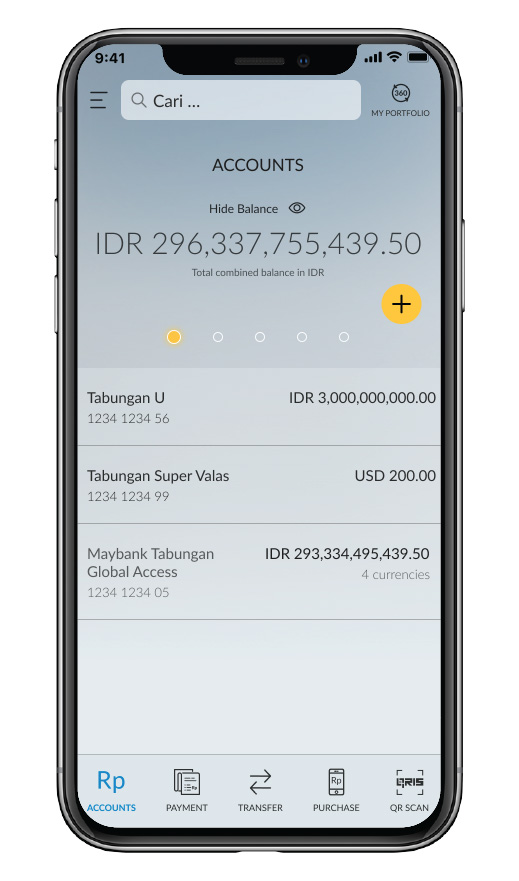

Login to the M2U ID App, click the top left

icon on your account screen, select Foreign Exchange Rates (to view

the updated rates).

|

|

|

Tap the yellow round button with three

dots.

|

|

|

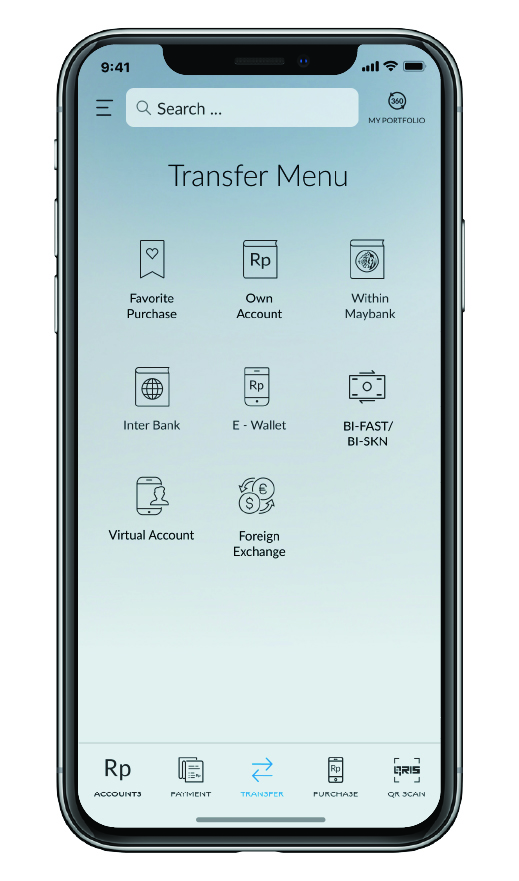

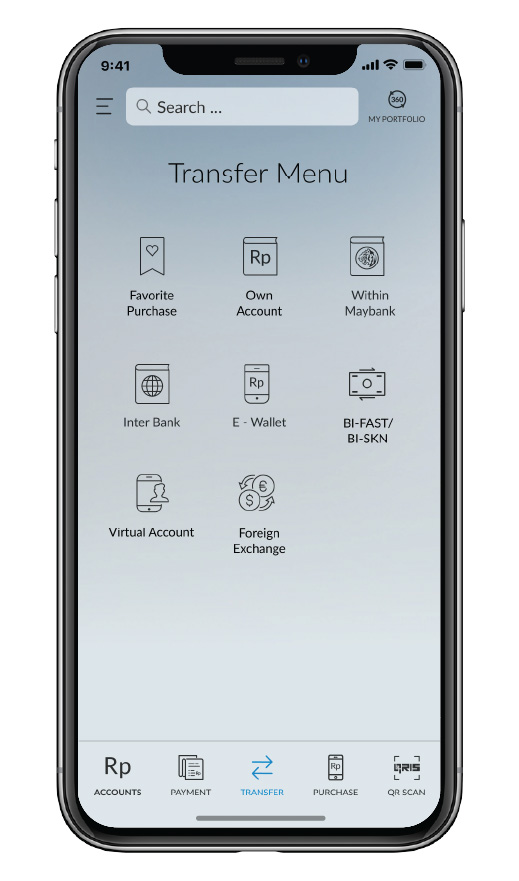

After the Transfer menu appears, select the

option “Other banks via SWIFT”

|

|

|

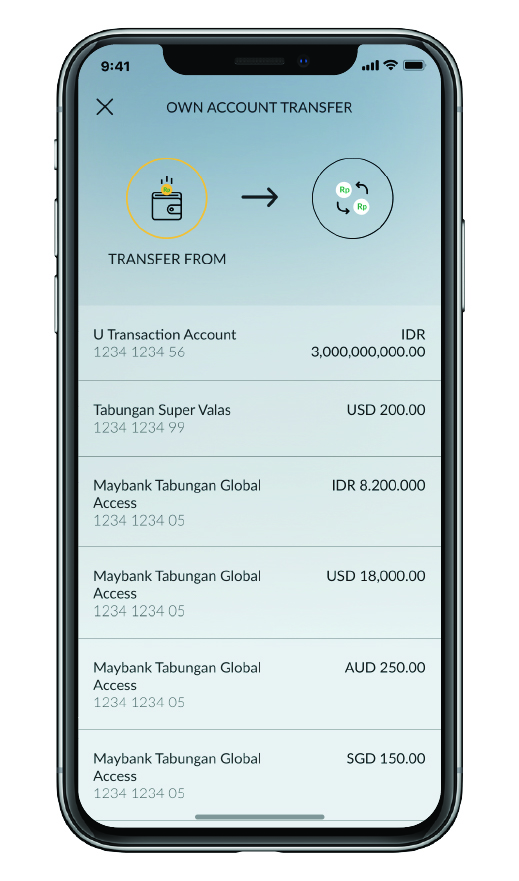

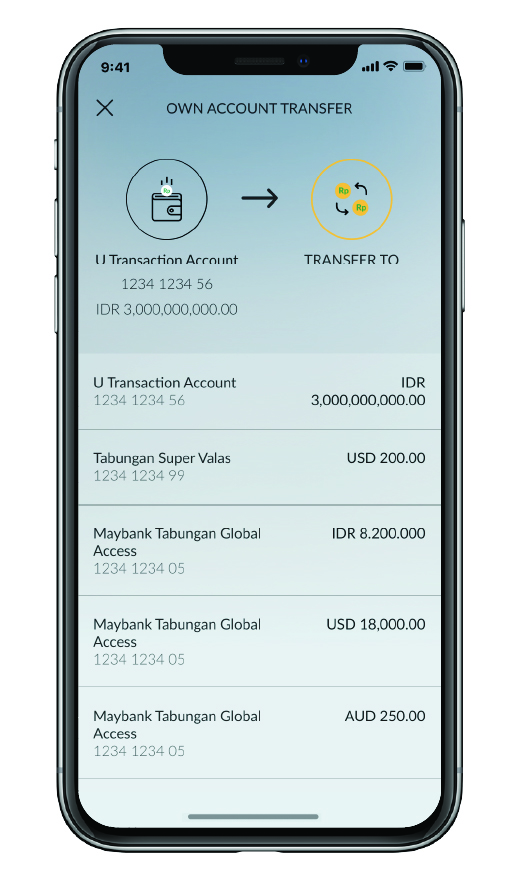

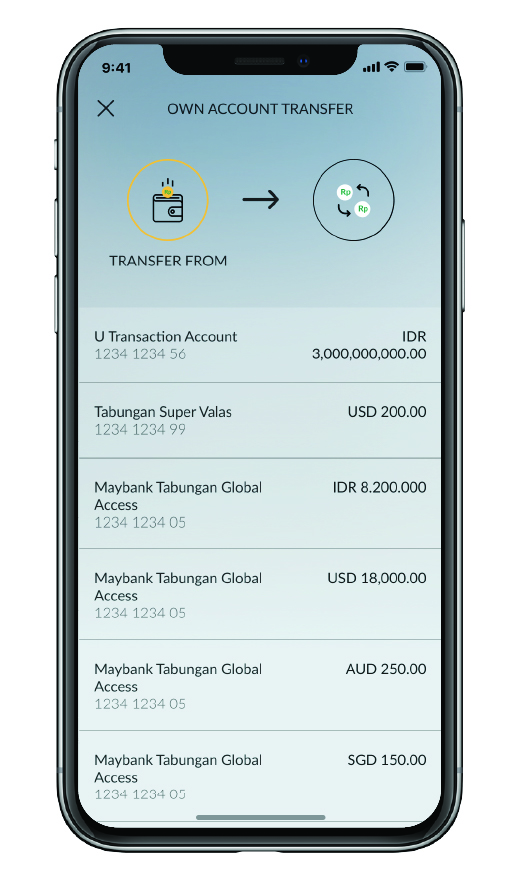

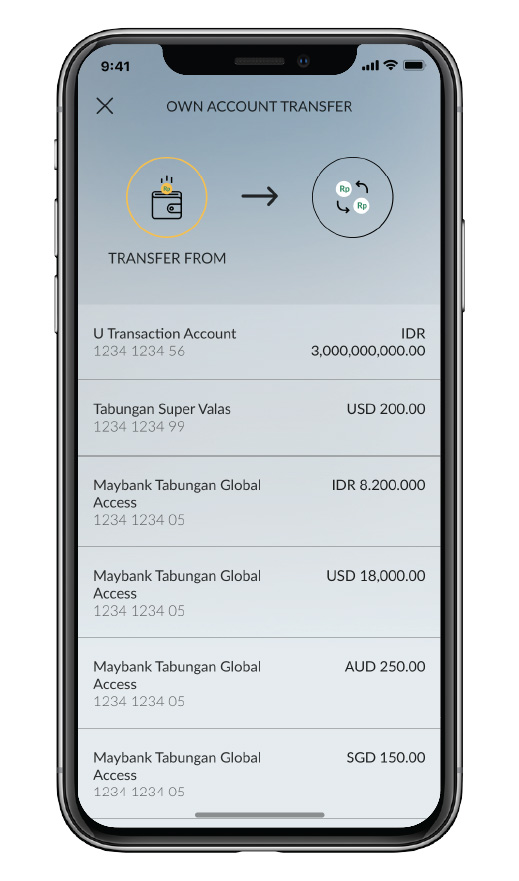

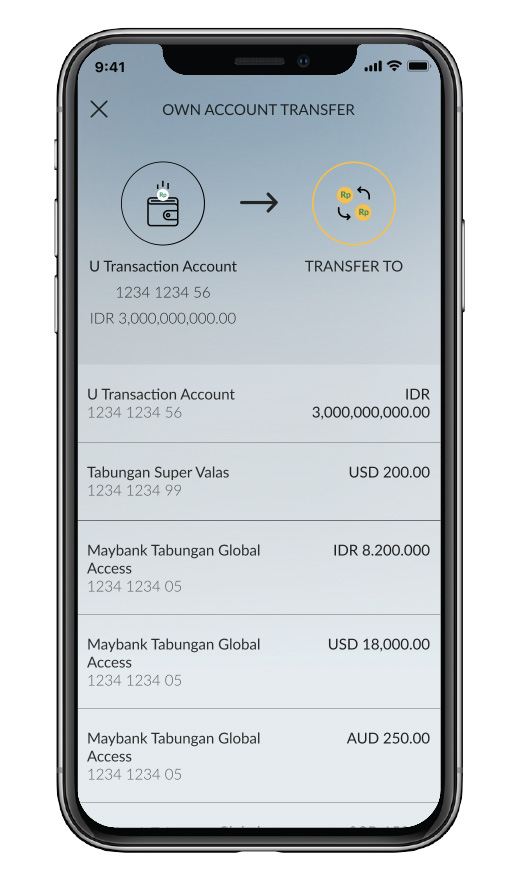

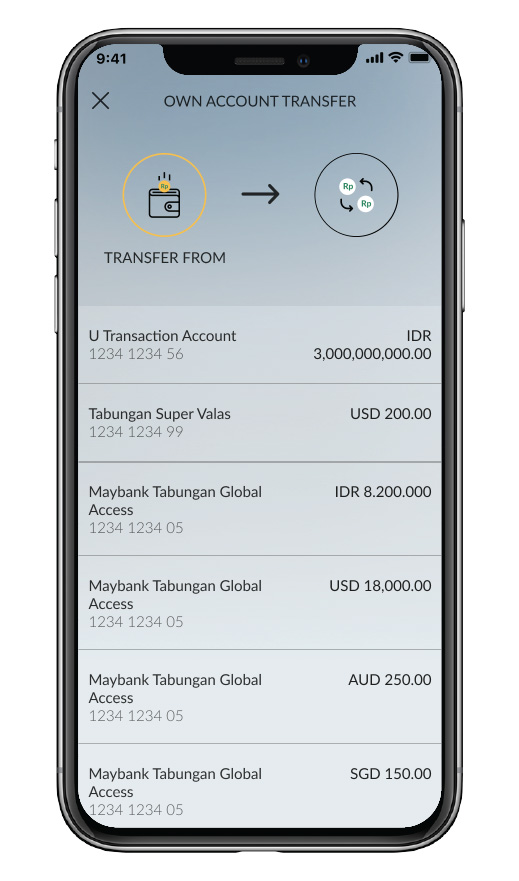

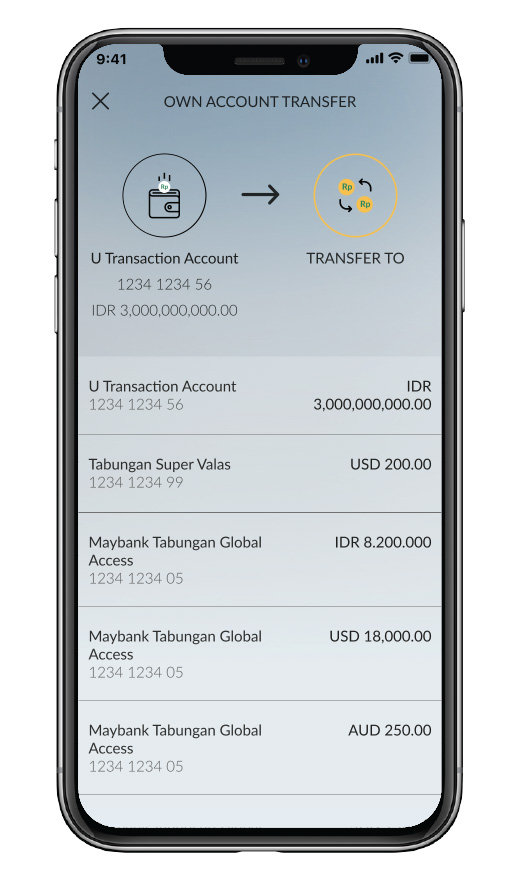

Select the source account

you want to use for the transaction.

|

|

|

Select ‘Destination Bank’

|

|

|

|

Select ‘Currency’

|

|

|

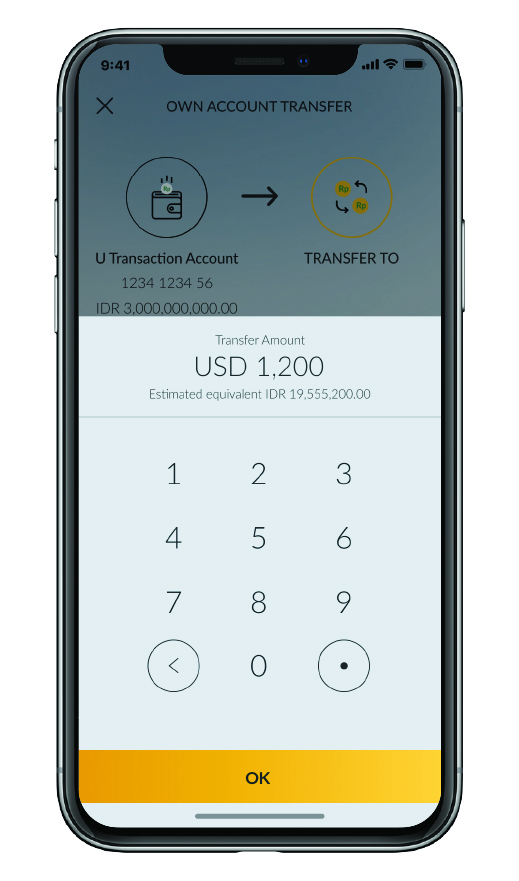

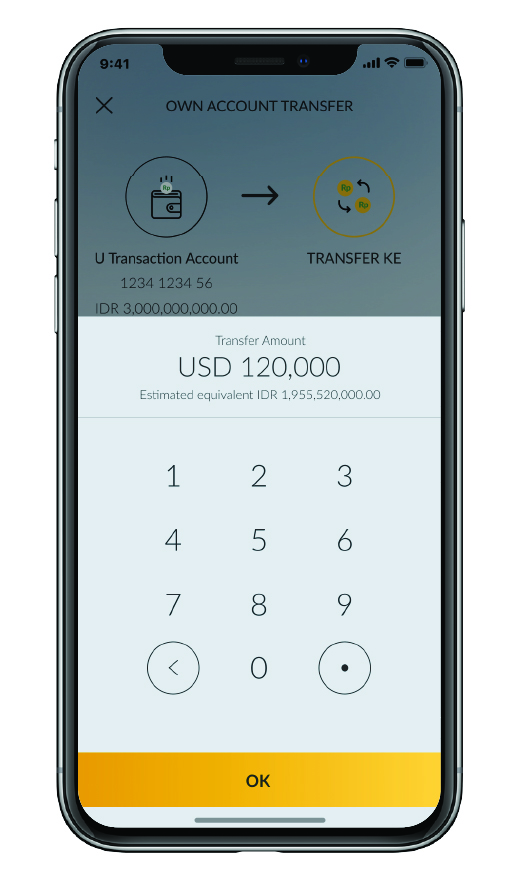

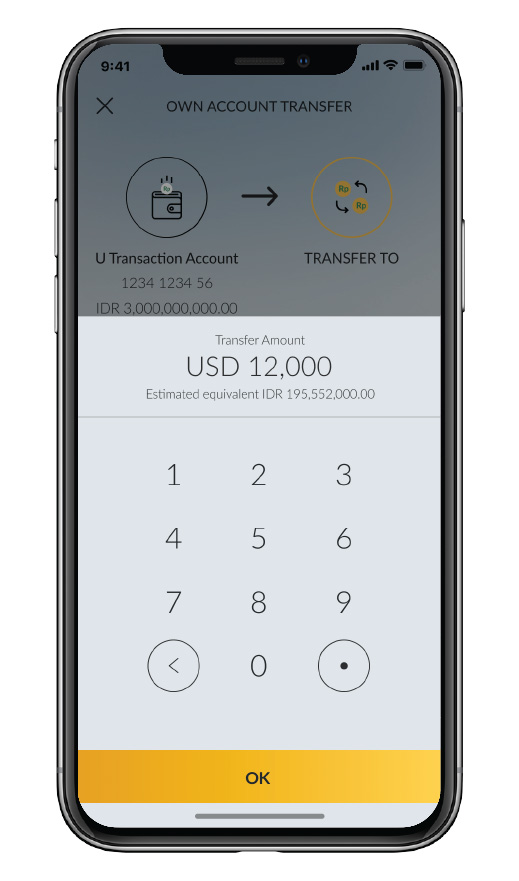

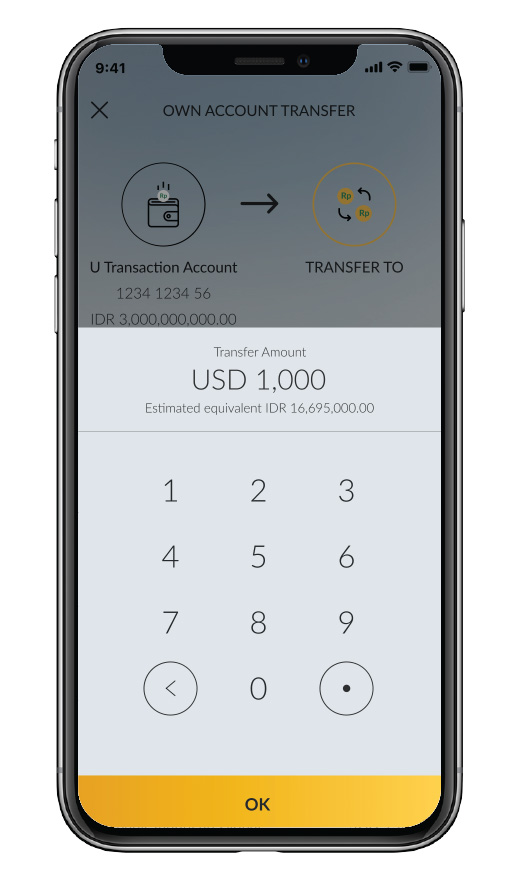

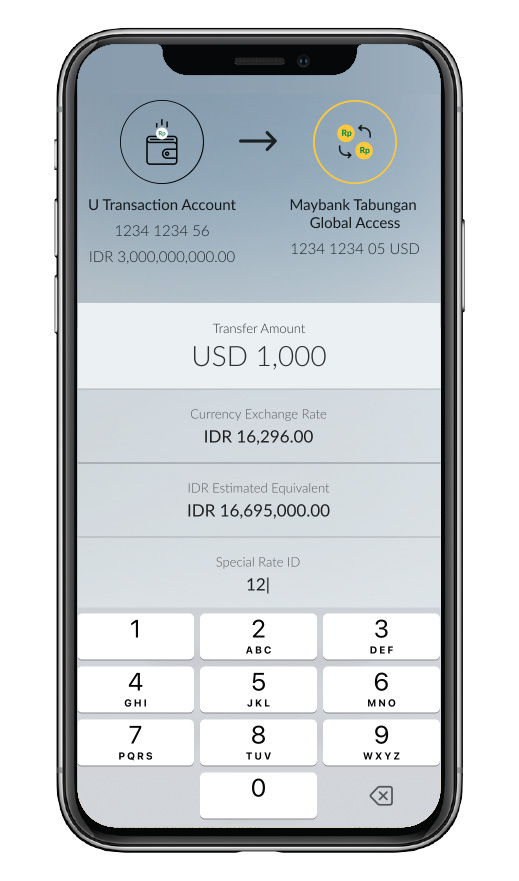

Enter the amount and recipient

information.

Check the box at the bottom if making a foreign currency

transfer of no more than USD 100,000 or equivalent per month per

Customer, then click Continue."

|

|

|

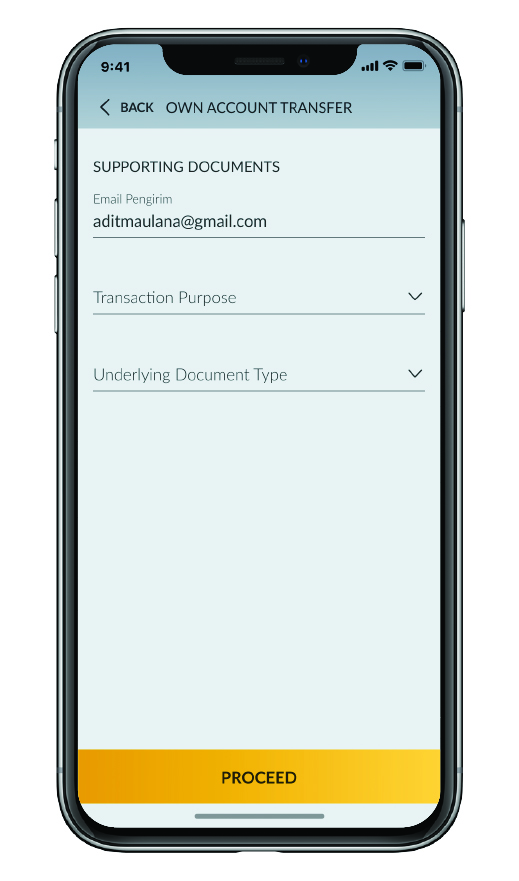

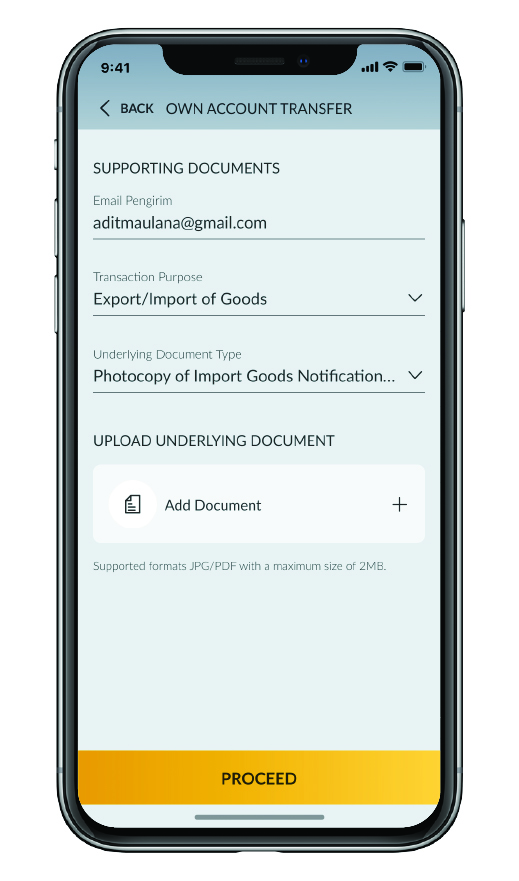

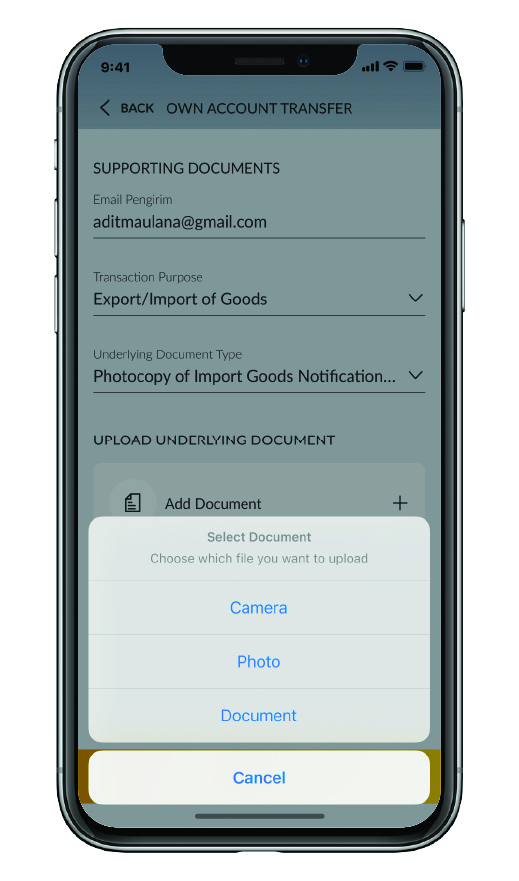

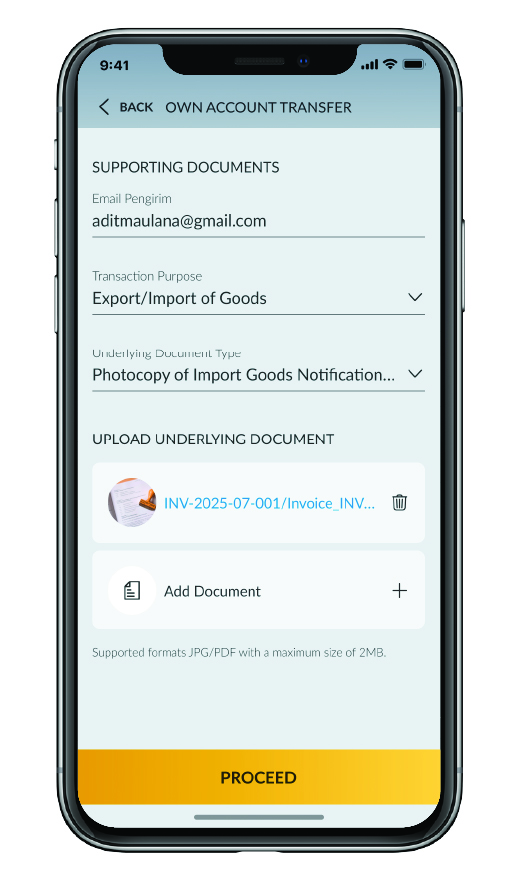

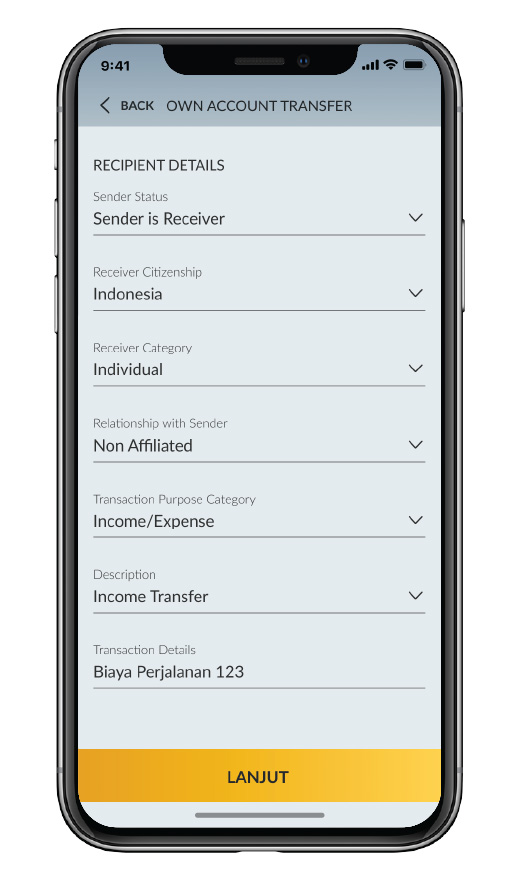

Enter the transaction purpose and type

of underlying document*. If the foreign currency transfer does

not exceed USD 100,000, select “Without Underlying”

An underlying document is required:

1.If the total foreign currency transaction amount will exceed the equivalent of USD 100,000 per month 2. For IDR-CNY transfers of any amount, to any bank located in or having branches in Mainland China." |

|

|

Complete the Foreign Exchange Traffic

(LLD) form.

Filling out the LLD form is required if the foreign currency

transaction amount exceeds the equivalent of USD 10,000.

|

|

|

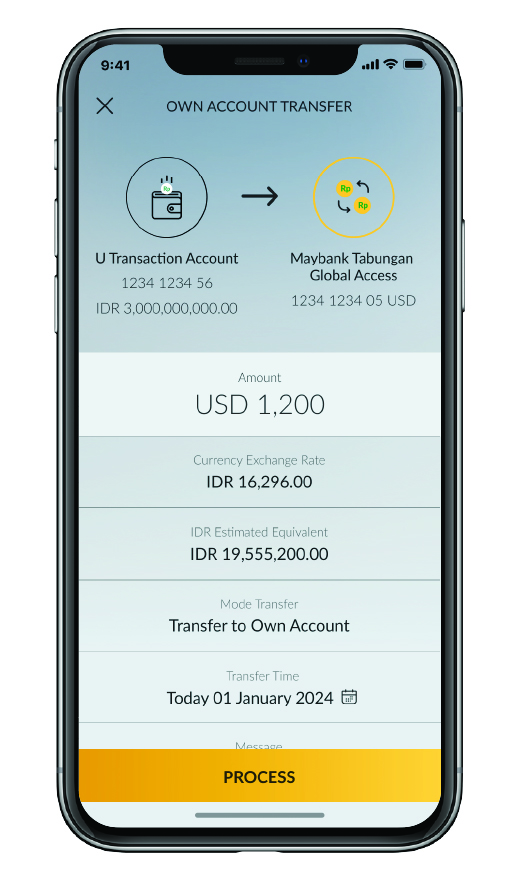

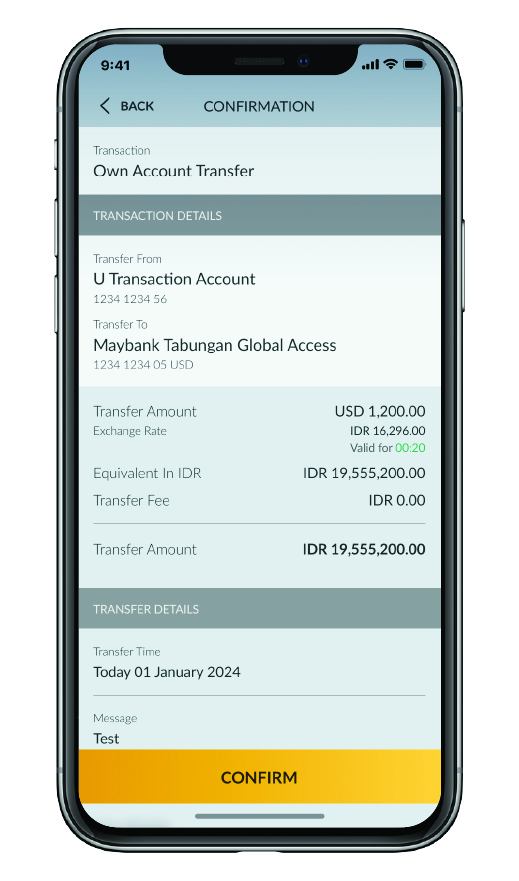

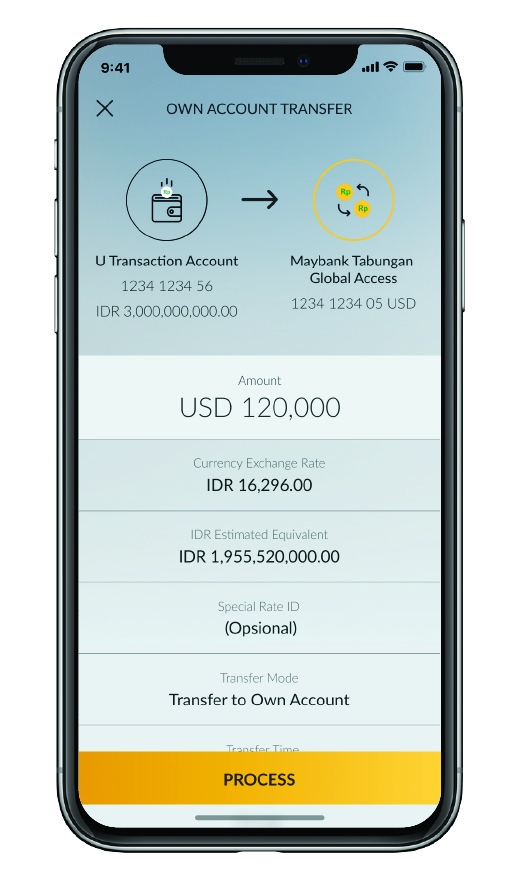

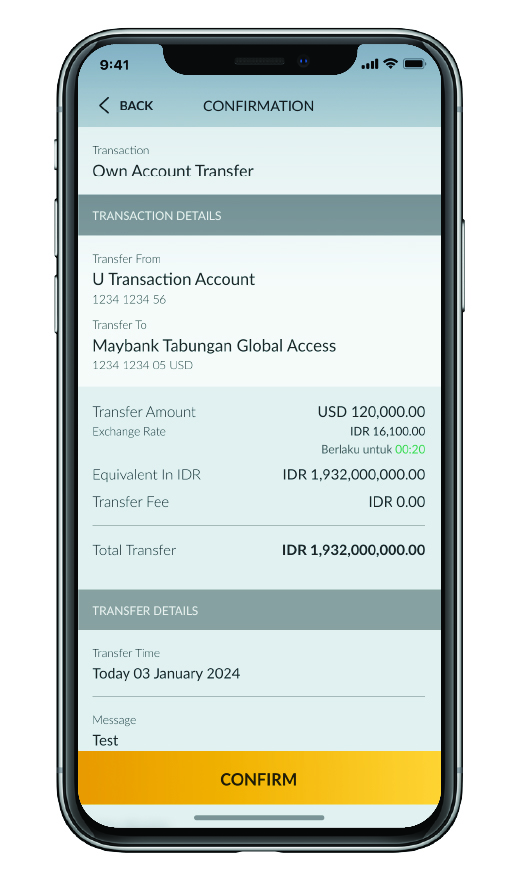

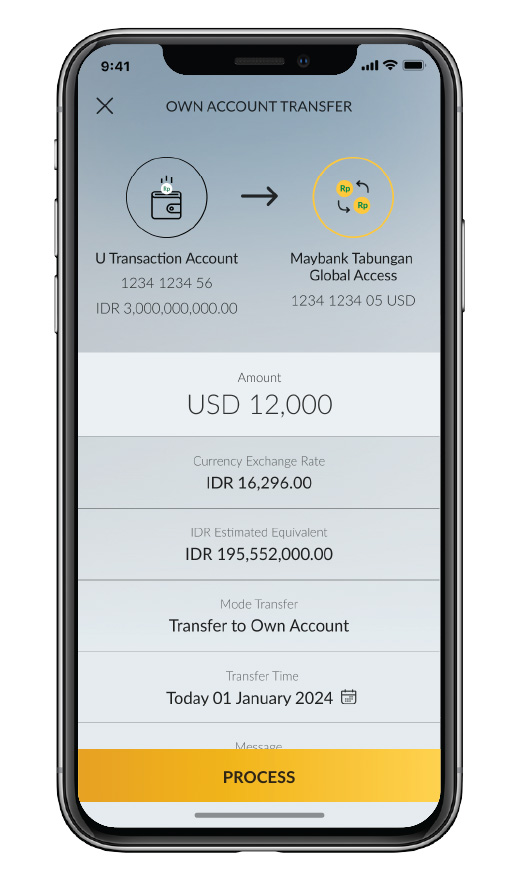

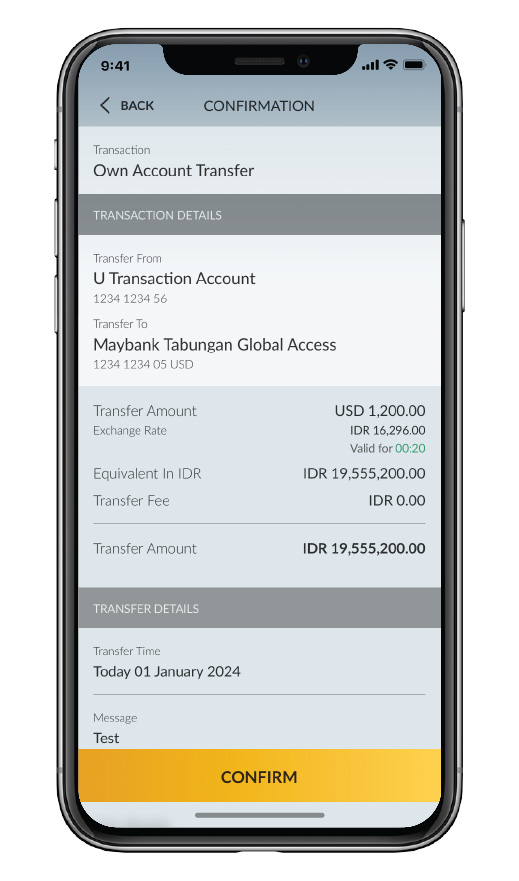

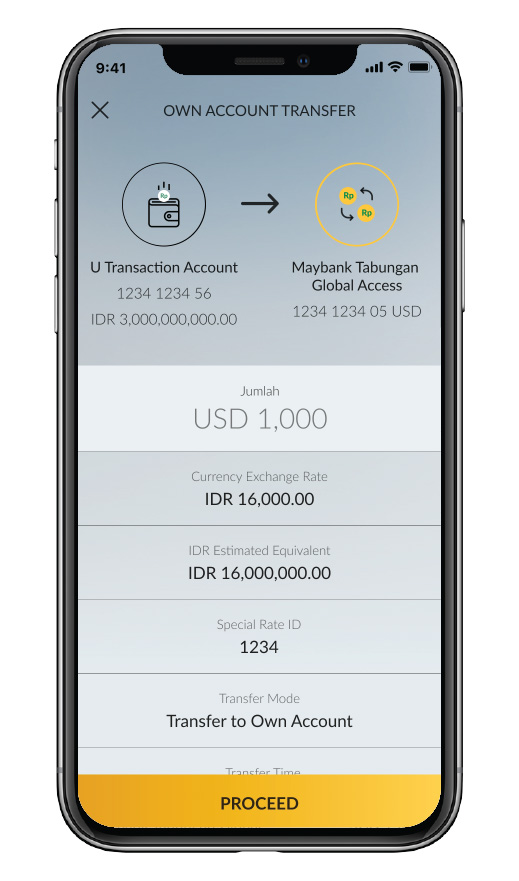

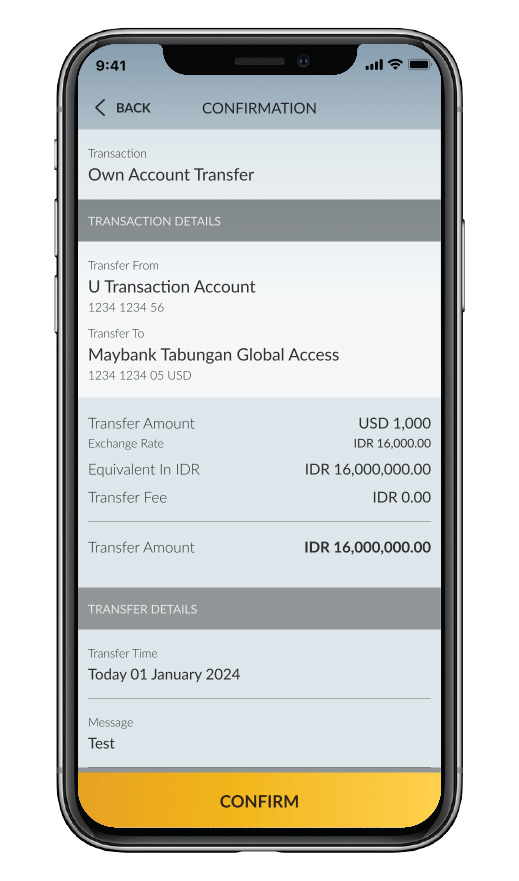

Make sure all the information is correct and

click confirm.

|

|

|

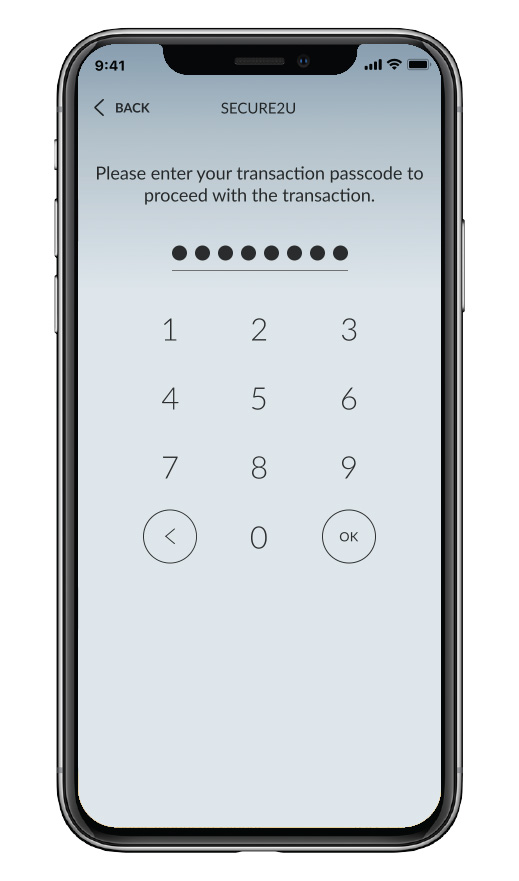

Enter the Secure2u passcode.

|

|

|

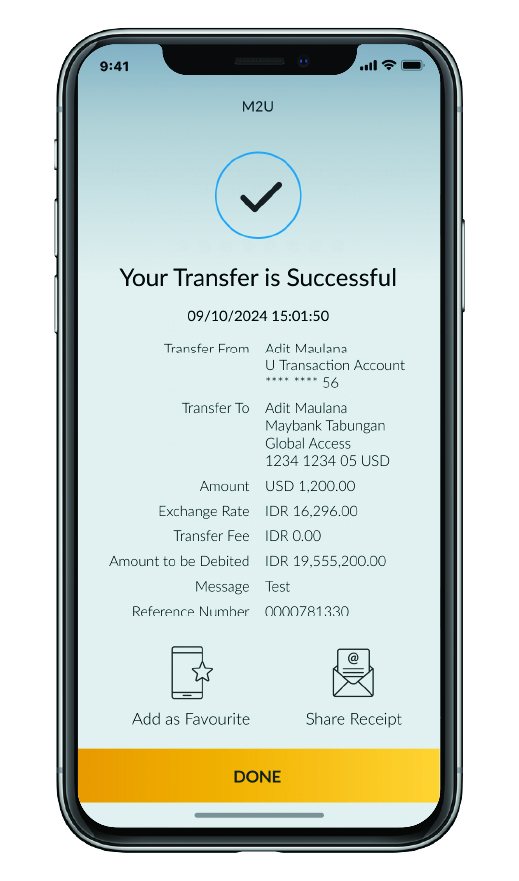

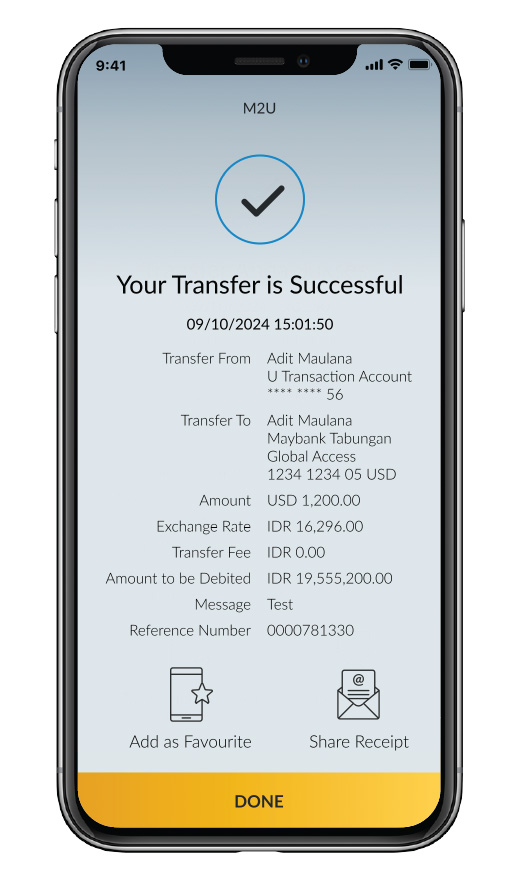

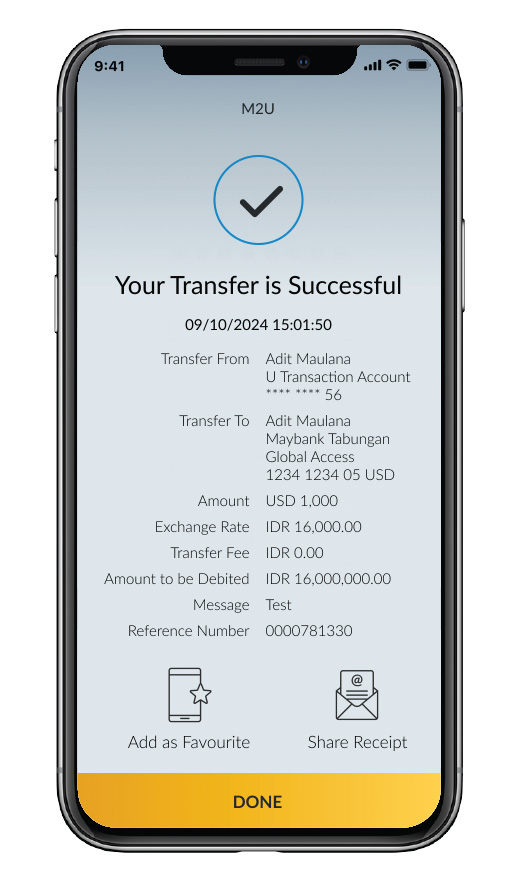

The foreign currency transfer has been

successfully processed.

|

|

|

Login M2U ID App, click the menu icon on the upper left of Your account screen, choose Foreign Exchange (to see the updated foreign exchange) |

|

|

Tap the three-dot yellow

button.

|

|

|

Once the Transfer menu

appears, choose “Other Bank via SWIFT”

|

|

|

|

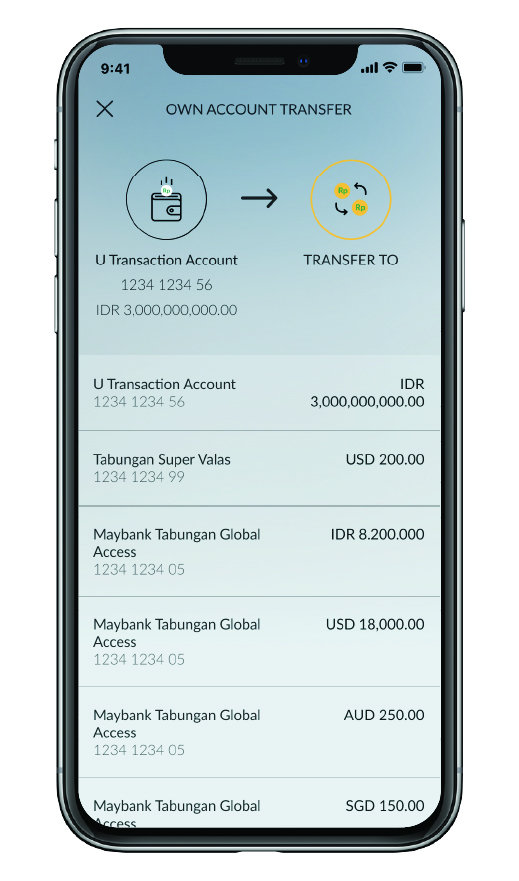

Choose the Source of Account

You want to use for Your transaction.

|

|

|

Choose Recipient Bank. |

|

|

Make sure the name of the recipient bank and SWIFT code are correct. Choose currency, then click Continue. |

|

|

Input amount and recipient information, checkmark on the box at the bottom if your foreign exchange transfer do not exceed USD100,000 or equivalent/month/Customer, next click Continue. |

|

|

Input Your transaction purpose and underlying document type*. If Your foreign exchange transfer do not exceed USD100,000, choose “Without Underlying” An

underlying document is required for IDR-CNY transfers in any

amount, to any bank located or branched in Mainland China

|

|

|

Verify all information are correct and click Confirm & Request TAC or Secure2u passcode. |

|

|

Enter TAC/passcode Secure2u passcode. |

|

|

Foreign exchange transfer has successfully been processed. |

|

|

|

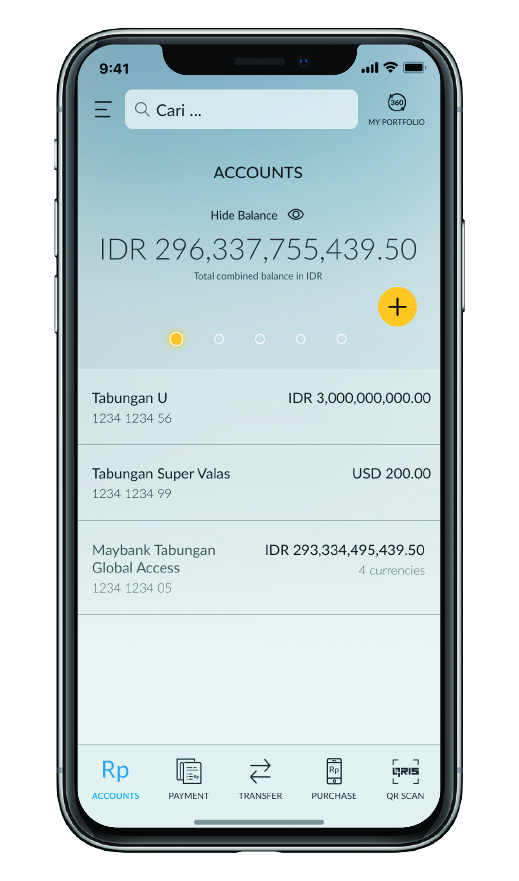

On your account dashboard, click the "Transactions" button on the upper right corner.

- Select “Transfer” menu on the transaction page.

- Select source of fund on the “Transfer from” column.

- Select “SWIFT Foreign Currency Transfer” on the “Transfer

to” column.

- Enter the beneficiary’s SWIFT code or enter the beneficiary’s bank name to search the SWIFT code.

- Click the “Search” button.

- Click on the SWIFT code area.

- Enter the beneficiary’s account number/ IBAN.

- Select the currency of destination country and enter the transaction amount.

- Select a correspondent responsible for transaction charges.

- Input the beneficiary's details.

- Click “Transfer” button.

Enter further beneficiary-related details, then click

"Transfer" to continue.

On the transaction confirmation page, check the transfer details once again and if appropriate please click “Request TAC”.

Input the TAC that has been sent to your registered phone number, then click “Confirm” to continue.

Your transfer has been successful. Click “New Transfer” to make another transfer or “Download Receipt” to get your transaction receipt.

Your transaction receipt has been successfully downloaded.

#MyBank