HELLO M2U

April - June 2025 Edition

What's New on M2U?

Access and Download Account Statement

Use the statement feature in the M2U ID App to monitor your spending and view detailed transactions.

Now, you can access and download your account statement or a combined financial report with more interactive graphics and charts.

E-statements for the current month will be available starting on the 10th of the following month.

Accessing your statement is now time-saving, eco-friendly, and practical—anytime, anywhere, right from your smartphone.

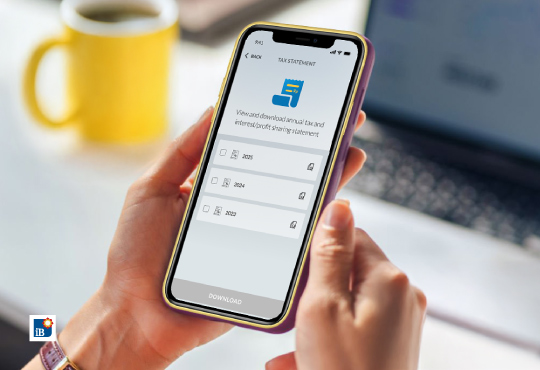

Access Tax Report

Simplify your annual tax reporting with the Tax Statement feature in the M2U ID App.

Now you can access and download your tax report on interest income from Maybank Savings, Current, and Time Deposit accounts directly through the M2U ID App. Available starting from the 2024 tax year.

Accessing your tax report is now more time-efficient, eco-friendly, and practical—anytime, anywhere via your smartphone.

Transaction History

You can now search for transactions using the search and transaction type features in the M2U ID App.

View your transactions by type, time period, or use alphanumeric keywords to easily find specific transactions.

Feature Highlight

Transfer up to IDR 10 Billion via M2U ID App / M2U ID Web

Meet your high-value transaction needs with transfer limits of up to IDR 10 billion through M2U ID App or M2U ID Web.

Applicable for RTGS (Real Time Gross Settlement), SKN (National Clearing System), BI-FAST, and transfers between Maybank accounts.

Make sure the destination account has been added as a favorite and verified via email to enable daily transfers of up to IDR 10 billion.

Easily Open a Pegadaian Gold Savings Account via M2U ID App

Easy for investment gold saving through the M2U ID App.

Not only can you buy and sell digital gold, now you can also request physical gold from your Pegadaian Gold Savings account—right from the M2U ID App.

Enjoy the simplicity of gold saving, all at your fingertips. #M2UinAja.

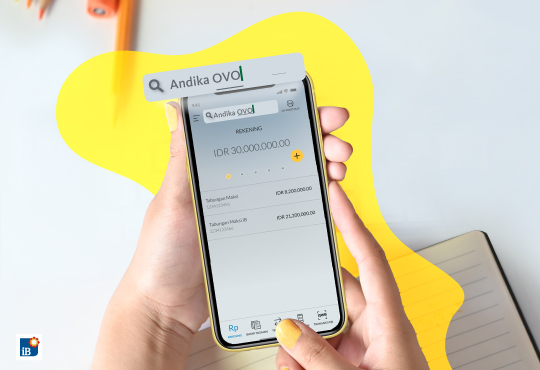

Faster Transactions with Smart Search on M2U ID App

Use the Smart Search feature on the M2U ID App to simplify and speed up your financial transactions.

With Smart Search, you can look up keywords related to transaction types, amounts, or destination banks, and you'll be directed to the relevant menu or transaction instantly. You can even search using voice commands for an even smoother experience.

Promo Highlight

Cashback up to IDR500,000 When You Buy Mutual Funds via M2U ID App

Take the smart step towards investing in Mutual Funds. Get cashback up to IDR500,000 when you make your first Mutual Fund purchase of at least IDR 1 million via M2U ID App. Investing in Mutual Funds is now easier and more practical through the M2U ID App—anytime, anywhere, all at your fingertips.

Program period until 31 May 2025.

Open a Gold Savings Account, Get Extra Gold Balance up to IDR 5 Million

Buy digital gold starting from IDR 1 million via M2U ID App and earn extra gold balance up to IDR5 million every month. The more you buy, the greater your chances to win this reward.

Program period until 30 September 2025.

Win a Vespa Scooter with Transactions on M2U ID App

Dreaming of owning a Vespa scooter for your road trips or an Apple Watch Ultra to support your daily activities? Now’s your chance to win a Vespa scooter, Apple Watch Ultra, as well as other prizes like IDR 6 million in gold savings balance and cash rewards up to IDR 1 million by making more transactions on M2U ID App. The more you transact, the greater your chances of winning these amazing prizes.

Program period 1 April – 30 June 2025.

Buy Electricity Tokens/Pay Electricity Bills via M2U ID App or M2U ID Web

Make sure your home stays powered to support your daily activities. Take advantage of Maybank's special anniversary program and enjoy 66% cashback up to IDR 25,000 when you purchase electricity tokens or pay electricity bills through M2U ID App or M2U ID Web.

Period: April 8 – June 30, 2025

Get IDR25,000 Cashback When You Pay Using QR Pay via M2U ID App

Shop or indulge in your favorite food, and pay conveniently with QR Pay via M2U ID App. Get IDR25,000 cashback with a minimum of 4 transactions totaling IDR150,000 during the program period. Valid at all merchants with the QRIS logo.

Program period 1 – 30 June 2025.

Tips & Trick

Tips for Investing in Digital Gold via M2U ID App

Gold investment has become an increasingly popular option, especially in times of economic uncertainty. Gold is seen as a reliable hedge, preserving wealth from inflation and market volatility.

With the new era & technology, investing in gold is easier than ever—no need to visit a physical gold store. Digital gold is gaining traction as a practical and accessible investment alternative. Here are some key reasons why digital gold is suitable for all generations:

- Gold Prices Are Relatively Stable

Gold is known for its long-term value stability. In times of global economic turbulence, gold prices often rise, making it a safe investment instrument. It’s widely used as a hedge against inflation and currency devaluation, offering financial security for every generation. - No Large Capital Required

Digital gold investment doesn't require a big initial capital. With digital gold, anyone—from students to young professionals—can start investing with just a small amount of money. - Easy and Convenient Access

No need to visit a gold shop or rent a safety deposit box at the bank. Digital gold transactions can be done entirely online. It’s secure, efficient, and removes the hassle of physical storage.

To support this, Maybank Indonesia, in collaboration with Pegadaian, offers the Gold Savings feature through the M2U ID App, providing a seamless and flexible digital gold investment experience. Here are some of the key benefits:

- Buy and Sell Gold Starting from Just IDR10,000

With M2U ID App, you can start buying gold easily from as little as IDR10,000. This makes gold investing accessible for everyone. Transactions are secure and directly integrated into the app. - Set Up Recurring Gold Purchases

Plan long-term investments with the recurring purchase feature. This automates your monthly gold buying process, so you don’t have to manually invest each time. - Real-Time Pegadaian Gold Prices

View up-to-date Pegadaian gold prices daily, helping you make informed investment decisions based on current market trends. - Convert to Physical Gold Anytime

Although your gold is stored digitally, the M2U ID App allows you to convert it into physical gold whenever you want.

How to Start Investing in Digital Gold via M2U ID App:

- Download and Open the M2U ID App

Download the app from Google Play Store or Apple App Store. Log in using your Maybank account. If you don’t have one, simply follow the registration steps. - Select Pegadaian Gold Savings

From the home screen, go to the “Investment” menu, then choose “Pegadaian Gold Savings” to begin your digital gold investment journey. - Choose the Amount of Gold to Buy

You can invest starting from just IDR 10,000. Enter your desired amount, and the app will calculate the total cost for you. - Choose a Payment Method

Pay using your Maybank account balance or via bank transfer. Double-check the amount before completing your payment. - Confirm and Complete the Payment

Confirm the transaction and tap “Pay.” Once completed, you’ll receive a confirmation notification. - Check Your Gold Balance

After your transaction, you can monitor your gold balance and investment value in real-time through the app.

Smart Tips for Gold Investing:

- Start Small:

Begin with small amounts and gradually increase your investment. It helps with budgeting and builds consistency. - Invest Regularly:

Make it a habit to invest in gold regularly. Even small monthly contributions can add up significantly over time. - Keep an Eye on Gold Prices:

Although regular investing is key, tracking price trends can help you choose the best times to buy—especially during price dips or stable periods.

With the convenience offered by the M2U ID App, digital gold investment is now easier than ever—anytime, anywhere, without hassle.

So, what are you waiting for? Start your digital gold investment journey today and enjoy long-term benefits!

Article

The Meaning of Qurban: More Than Just a Yearly Ritual

By: Wang Wardhana – Head of Syariah Wealth Management

Qurban (sacrificial offering) is one of the core acts of worship in Islam, performed annually during Eid al-Adha. However, it goes beyond just a yearly routine—Qurban carries deep spiritual significance. That’s why having a solid financial plan is important, allowing us to perform this worship peacefully, sincerely, and without financial strain.

Why You Should Plan Ahead for Your Qurban Fund

Many people find themselves rushing or feeling pressured financially as Eid al-Adha approaches, especially when faced with the high cost of sacrificial animals like goats or cows—especially if they wish to offer an entire animal. Planning early can help avoid this.

Benefits of Early Planning:

- Doesn’t disrupt your monthly finances

- Gives you the option to choose better quality animals

- Enhances your mental and spiritual readiness

Save Smartly and Easily with M2U ID App

Maybank Indonesia offers a digital solution via the M2U ID App to help you prepare your Qurban funds in a more practical and well-planned manner. Supporting Features:

- Goal-Based Savings (Tabungan Berjangka): Set your target amount and timeframe. The app will automatically allocate funds on a scheduled basis.

- Notifications & Reminders: Stay consistent with your savings until you reach your goal.

With M2U ID App, saving becomes more disciplined and automated—helping you avoid forgetfulness or the temptation to use the funds for other needs.

Choosing the Right Qurban Animal in Accordance with Islamic Guidelines

Once your fund is ready, the next step is selecting a suitable Qurban animal. Islam outlines several requirements:

- Must be healthy and free of disease

- Must meet the age criteria (at least 1 year for goats, 2 years for cows)

- Must be physically fit—not blind, lame, or extremely underweight

Extra Tips:

- Compare prices from different sellers or markets

- Learn when the best time to buy is to get better deals

- If you don’t have time or space for slaughtering, consider participating in a trusted collective Qurban program

Financial Discipline: A Positive Side Effect of Qurban Planning

Beyond the spiritual aspect, saving for Qurban builds good financial habits. It teaches:

- Discipline in managing finances

- Consistency in saving

- Prioritization of spiritual and social values

Over time, this can become part of a healthy Islamic lifestyle—both financially and socially.

Fulfill Your Noble Intention, Starting Today

Qurban is not just about what we sacrifice—it’s about the values we instill in our lives. With proper preparation, we not only fulfill the act of worship meaningfully, but we also bring greater benefits to others.

With M2U ID App, your noble intention becomes easier to realize—through a more modern, practical, and consistent approach. Start today—because even the smallest step now can bring great blessings when Eid comes.

Ask the Expert

Sharia-Based Financial Planning for the Future

By: Wang Wardhana – Head of Syariah Wealth Management

In Islam, financial planning is not merely about managing money to gain profits, but also about ensuring that each financial step brings blessings and aligns with Sharia principles. This is where the concept of Shariah Wealth Management becomes relevant.

Shariah Wealth Management emphasizes values such as justice, transparency, and freedom from riba (usury), gharar (uncertainty), and maysir (excessive speculation). Therefore, every financial decision made is not only materialistically profitable but also provides peace of mind, as it is in harmony with religious teachings.

A variety of Sharia-compliant financial instruments are now available to help you build a strong and halal financial future. These include mudharabah-based savings, which focus on profit-sharing; takaful (Sharia insurance), which emphasizes mutual assistance; and sukuk investments, which are a halal alternative to conventional bonds.

Maybank Indonesia, through its Shariah services and the M2U ID App (mobile banking), is here as a trusted partner to help you achieve financial planning in line with Sharia principles. Whether it’s opening a Sharia-compliant savings account, setting financial goals, or saving for Qurban (sacrificial offering)—all can be done easily and securely through digital means.

Let’s fulfill noble intentions, such as performing Qurban and securing your family’s future, with wise, well-planned, and of course, halal financial steps.

See Hello M2U in Bulletin Version

OTHERS

Customer Support

Japan Desk

Promotion

Contact Center

News & Announcements

KPM Privilege

Locate Us

Refer a Friend

Fees & Charges

Rates Information

Maybank Basic Credit Interest Rate

Customer Education

External Link

Whistle Blowing

Security Privacy and Policy

Social Media Community Guidelines

Select Country