M2E

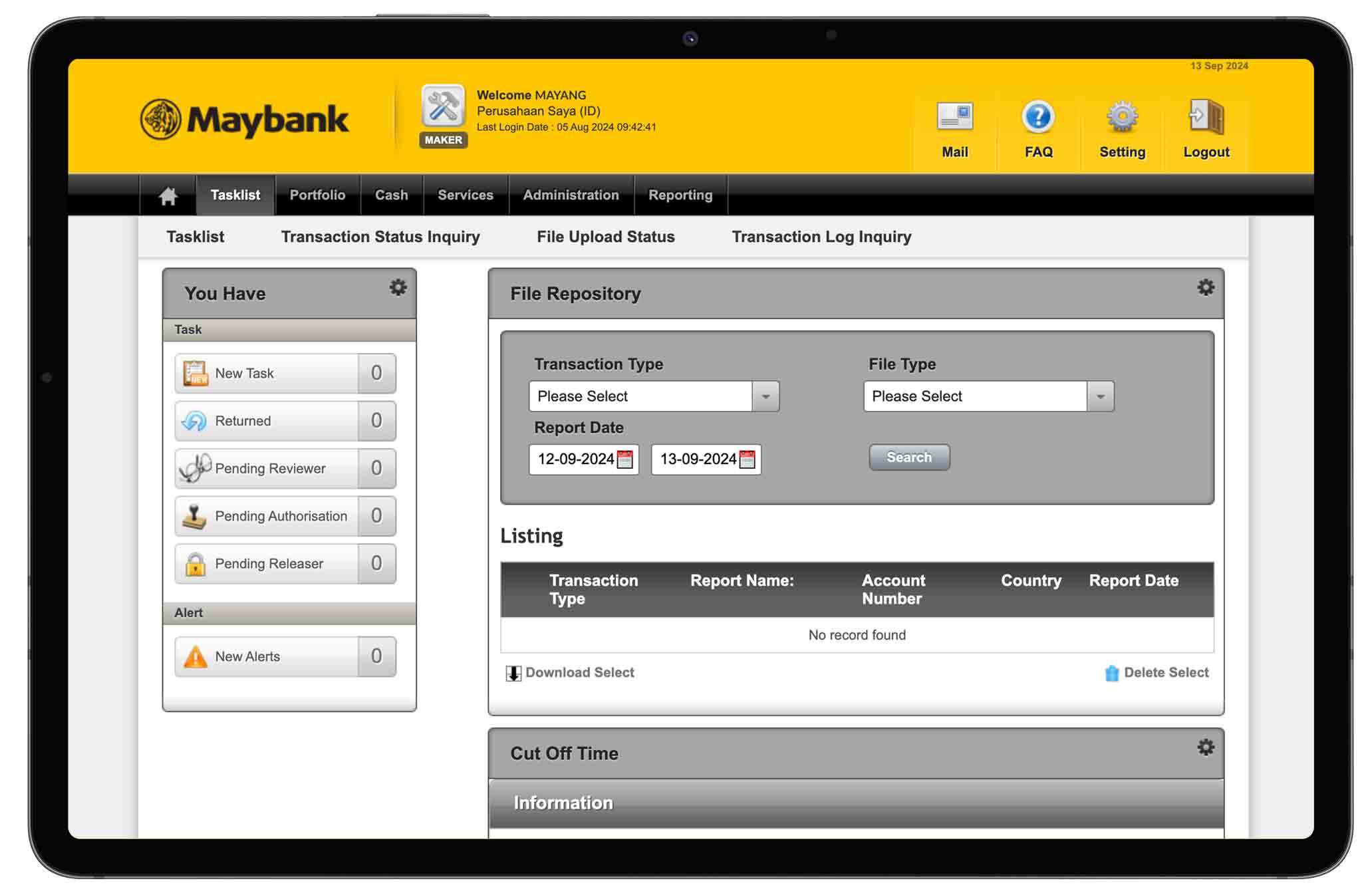

M2E is an electronic banking solution with regional capabilities that can be accessed through a secure network, making it easy to manage your business's cash management.

Manage your business finances with M2E!

M2E serves as a reliable financial transaction solution for your company through organized transaction reports. With M2E, managing your company's cash flow/cash management and foreign currency transfers can be done anytime, anywhere. Additionally, you can also manage your business expenses with M2E.

Advantages of M2E

Flexible

Access M2E anytime, anywhere through various devices (Windows, Android, iOS)

Easy to Use

Easy and convenient transactions using multi-factor authentication.

Personalize

Workflow and user access matrix can be configured according to needs.

Complete Portfolio

Displaying the required banking information.